Prime Day is here! This 48-hour sales event of summer is primed (see what I did there?) to eclipse past years’ sales and outshine Black Friday. As a consumer and marketer, I’m eager to explore both sides of the coin, and of course, add everything to my Amazon cart.

Let’s dive in.

Prime Day for Consumers

Some experts caution shoppers to jot down their needs (and wants) prior so you avoid impulse shopping, but know those coveted lightning sales and general sales may not be the best bang for your buck.

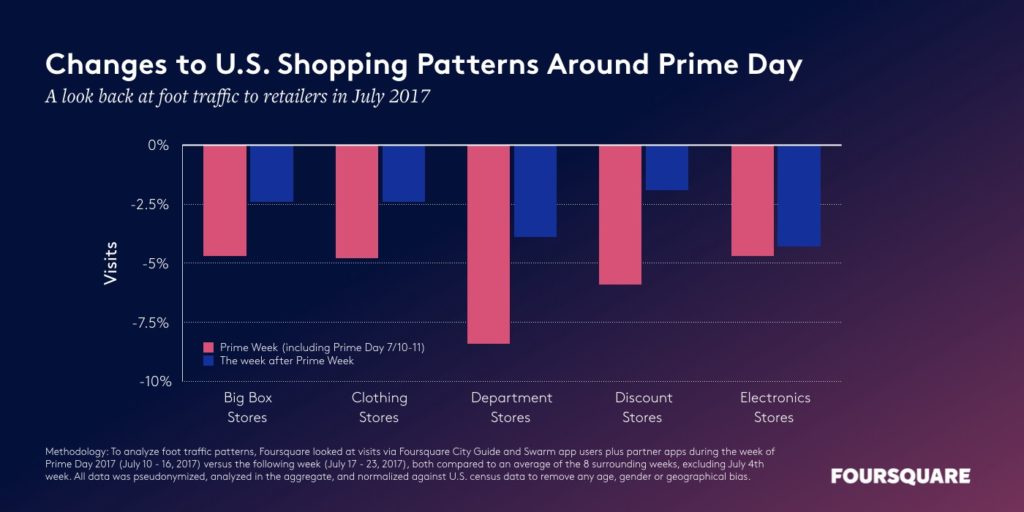

Consumers still value shopping around to find the best deals possible. While 68 percent of Adlucent survey respondents are planning to shop Prime Day, they’ll still comparison shop to find the best deal. Companies like Target, Walmart and eBay are eating up this opportunity to not only compete but take advantage of this shopping holiday. Walmart – the biggest Amazon competitor – claimed nearly 50 percent of online sales outside of Amazon, according to Marketing Land.

Prime Day for Advertisers

It’s easy to get caught up in the 48-hour window media planning frenzy by spending high dollars in paid search and social, but long-term ecommerce media planning is key. This is a marathon, not a sprint. Advertisers should examine their product listings to maximize Prime Day shoppers, but set themselves up for later back-to-school and holiday shopping. A Profitero study of more than 1,600 products on Prime Day 2018 found increases in sales were dependent on the sales discount.

Discounts of less than 20 percent delivered a two-time increase in sales, while not severely impacting profit margins – sales of 21-30 percent delivered sales gains of 493 percent, while 31-40 percent discounts generated a boost of 767 percent, according to eMarketer. Some of this revenue and product movement comes from Lightning Deals, which is limited-quantity, limited-time offers that can give products a broader reach/exposure. Lightning Deal prep is a perfect opportunity for companies to gear up presence – both organically and paid – to participate in these coveted deals since they’ve since closed entry in May.

Joe Kaziukenas, CEO and Founder of Marketplace Pulse says, “The lift in sales you’re going to have by doing a Lightning Deal is obviously going to be multiple times greater than if you just expected an organic lift off a Prime Day. If you want a big increase in sales, and thus a big increase in popularity on Amazon, then a Lightning Deal is probably the best way to do it. Ultimately, you kind of give up the market for it.”

The Prime Day Halo Effect

Profitero conducted an analysis of “more than 13,000 products that grew traffic at least 50 percent on Prime Day 2018 vs. two weeks preceding the event to examine how the products performed post-event. The results found a strong halo effect where 66 percent of products analyzed had elevated sales levels two weeks after. And of those products experiencing a halo effect, there was an average traffic increase of 37 percent during the two-week, post-event period as compared with the two-week, pre-event period. Conversion rates declined from 24 percent to 22 percent during those times, but given the significantly higher traffic levels, brands still came out way ahead in driving post-event sales.”

Prevailing Beyond Prime Days

Prime Day is just two days in a long season, so what’s the big deal for your media plan? The estimated $5 billion in sales over the next two days should pique your interest, but your presence in the Amazon powerhouse can show long-term growth for your brand. (Learn more in our previous Amazon ad blogs.) An estimated 57 percent of brands utilize paid advertising on Amazon, and of those, 69 percent saw revenue growth over time. When talking dollars and sense when looking at Prime Day advertising cost on sales versus an annual (total) Amazon cost on sales, you’ll end up with the better deal long term.

You’ll see an incredibly high advertising cost on Prime Day, but simultaneously kickstart a flywheel effect that drives reviews and future organic sales. And everyone wins when my Prime packages arrive, and our clients see leaps and jumps when adding Amazon to their cart.

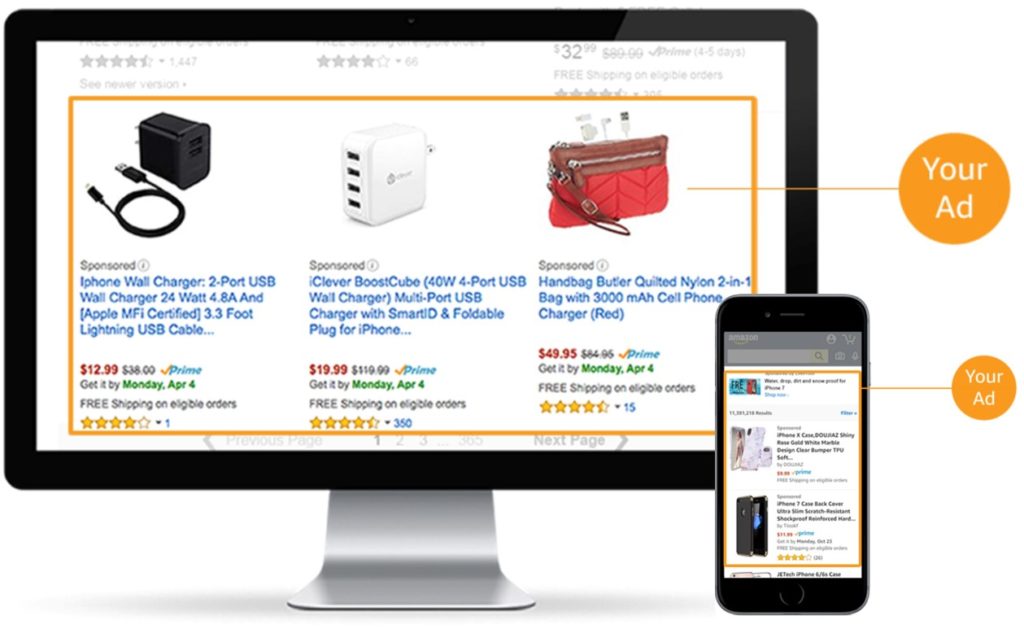

Using predictive data from past purchases and real-time shopping insight, AAP serves up arguably the most relevant advertising at the time of decision. This puts advertising across Amazon’s owned-and-operated sites and apps at the bottom of the funnel.

Using predictive data from past purchases and real-time shopping insight, AAP serves up arguably the most relevant advertising at the time of decision. This puts advertising across Amazon’s owned-and-operated sites and apps at the bottom of the funnel. Advertising options are plentiful across the sites, which include IMDb and Amazon Prime Video, as well as third-party exchanges. By 2022,

Advertising options are plentiful across the sites, which include IMDb and Amazon Prime Video, as well as third-party exchanges. By 2022,