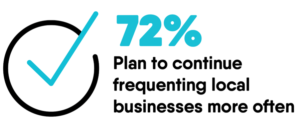

During the onset of the pandemic and throughout 2020, consumers consolidated their shopping trips to fewer retailers. Some did away with unnecessary expenditures due to fear of exposure in-store or newfound financial hardship, while others purchased brand replacements at competing retailers or found more convenient, digital means to procure their favorite products. As a result, brands shifted to a more digital-first strategy and expanded their service offerings to improve the customer experience. Services like curbside pickup, buy online-pickup in store (BOPIS), same-day pick up, free delivery and exclusive discounts became the norm throughout the beginning of the pandemic, but now that consumers have become accustomed to those convenient services and exclusive offers, they’re now expected in order to continue the brand/consumer relationship.

As we move into this holiday season, how are brands looking at consumer-centric service offerings, as well as their media strategy, to stand out in the crowded space of seasonal advertising?

Let’s explore some of the trends from the last year that will continue into holiday season and beyond 2021.

Less physical, more digital

Many national retailers have already communicated that their physical stores will be closed on Thanksgiving day, November 25, but that doesn’t mean sales will stop. Digital deals will be the priority when stores are closed and remain so throughout the holiday shopping season. With consumers having adapted to online shopping over the last year and a half, many now prefer the convenience of clicking or tapping to make purchases, as opposed to visiting in person. And since holiday shopping season has traditionally been associated with long lines and crowds, more consumers will opt to avoid the masses—41 percent, in fact—to save time and feel safer against the continuing pandemic spread.

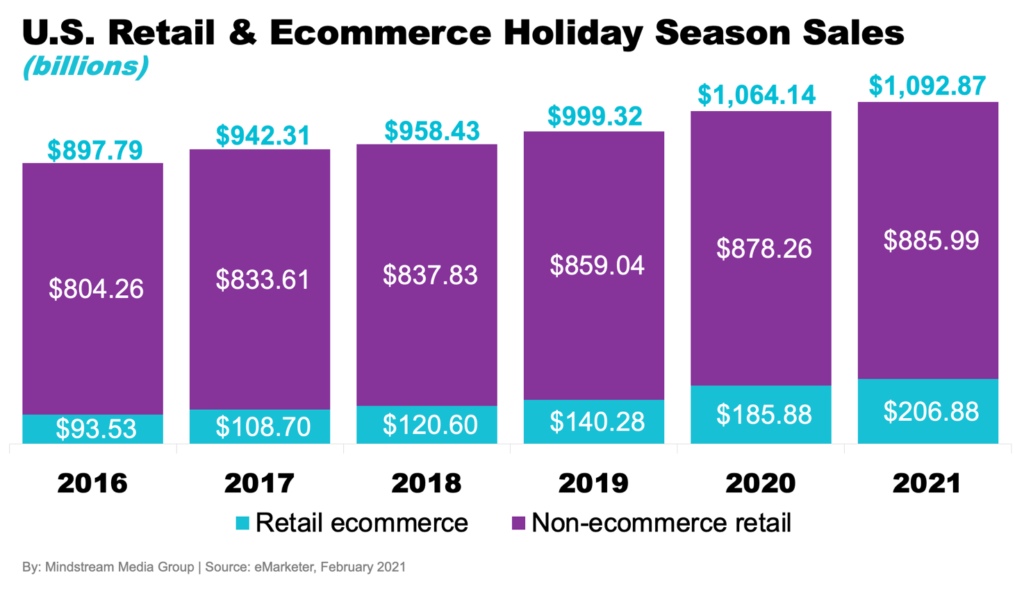

Retail ecommerce holiday season sales continue to grow and are expected to reach over $206 billion in 2021, according to eMarketer’s Holiday Preparedness Report. That is a 47 percent increase, or over $66 billion, more than the pre-pandemic 2019 levels.

Regardless of whether your brand operates physical locations, consumer demand for digital deals remains strong. In addition, around 40 percent of consumers are looking forward to more digital experiences using AR and VR technology, like home makeovers, beauty product sampling, virtual clothing try-ons, personal shopping, home lighting displays and more.

This growth is being driven by increased ecommerce sales across several categories. Fueled by the return of in-person events, discretionary categories like jewelry, luxury and accessories are expected to see the highest increase at 25.5 percent. Although at a much slower pace, spending on consumer electronics in the form of new devices and wearables is forecast to be the second-fastest growing category at 12.5 percent. Rounding out the top three, strong demand for cosmetics and beauty products will drive a 12.1 percent increase in the personal care and health category.

Earlier shopping season

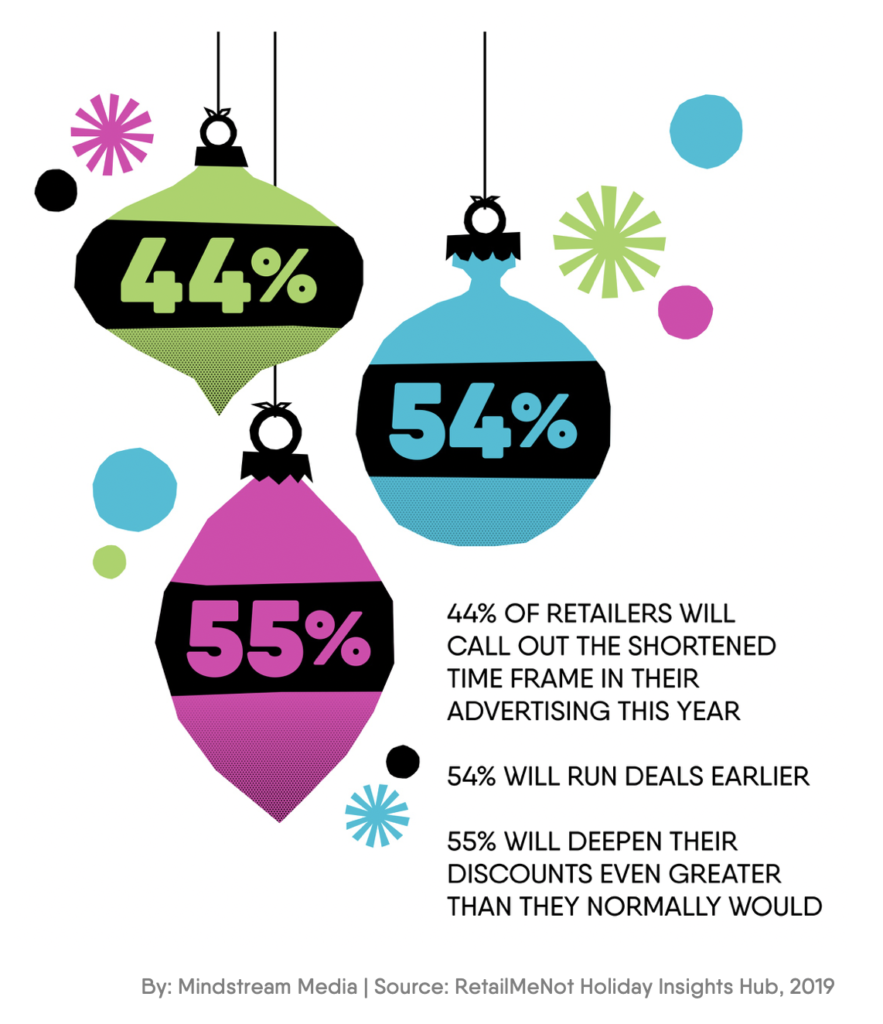

In 2020, 42 percent of shoppers started their holiday purchasing earlier than in years prior. And this year, over half (53 percent) of consumers will start holiday shopping before November, according to a recent Integral Ad Science webinar.

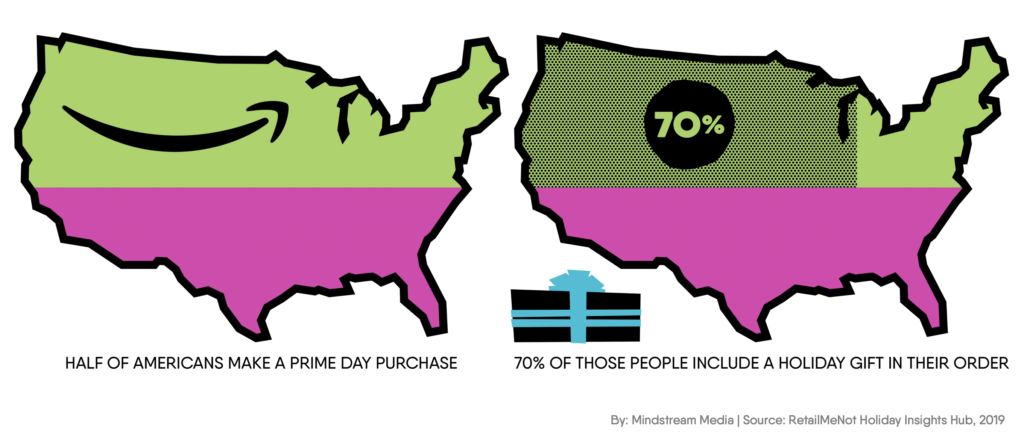

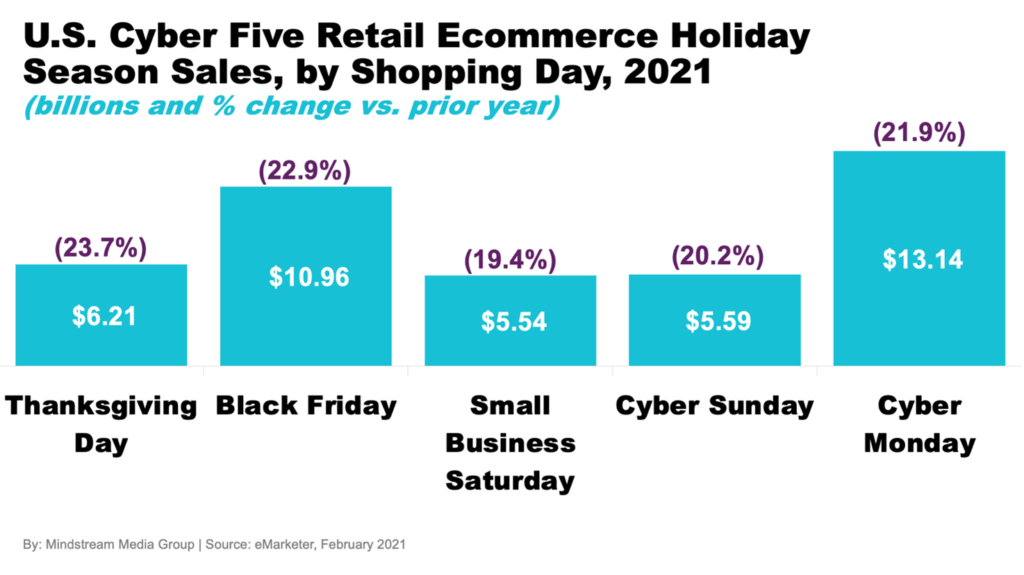

eMarketer projects the Cyber Five will grow their sales at above-average rates this year while increasing their share of the season from 18.3 percent to 20 percent. Cyber Monday is expected to rake in the most online spending followed by Black Friday and Thanksgiving.

One in three holiday shoppers are planning to spend more this year. Getting early access to discounts and deals is a top priority, with 45 percent of shoppers ranking it as number one on their list.

Advertisers can use the earlier shopping season to their advantage by starting campaigns early and by focusing on connecting with potential consumers at every stage of their journey, from brand awareness to purchase consideration. A partner like Mindstream Media Group can help brands focus on human connection throughout the customer journey, across media channels.

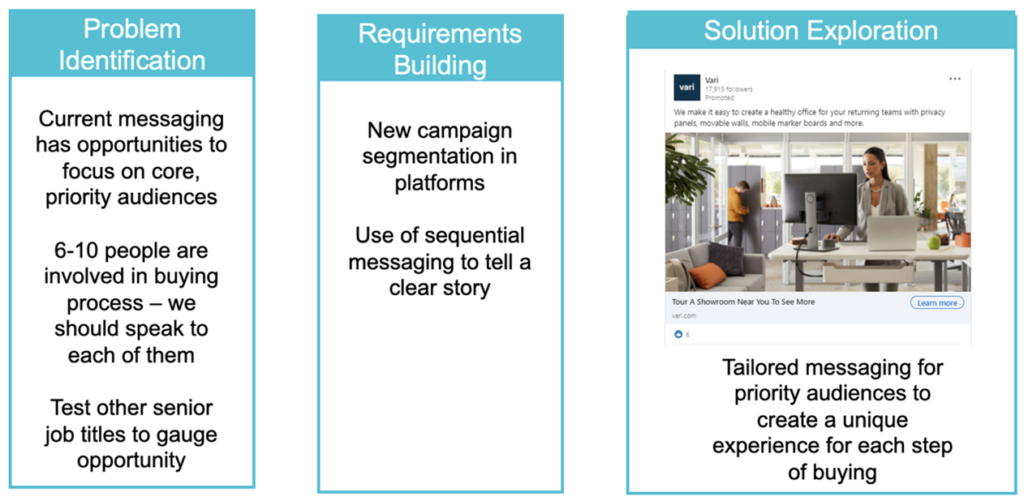

A current exercise we’re conducting is focused on understanding the purchase cycle through a B2B lens. B2B often has much different needs that normal DTC campaigns don’t encounter such as meaningful lead submissions. This exercise is looking at the business problem, value prop our client offers and their best-in-class solution through creative messaging that reaches not only the final decision maker but influences the other necessary teams.

Loyalty and first-party data

Marketers are now preparing for the demise of third-party cookies in 2022. Brands are developing their own means of collecting data, building out their own consumer profiles and personas and using first-party data to increase ad personalization and relevance to build trust with their audiences.

According to a 2021 Consumer Survey conducted by Outbrain, the top-two factors that drive engagement for consumers are trusted ads that meet their personal interests making personalized and contextually relevant ads important.

In addition to building trust with potential consumers, better ad personalization and relevance pays off. IAS research shows that 76 percent of consumers will maintain or increase their holiday shopping budget from last year. And holiday shoppers are looking to digital ads to contribute to their shopping experience, with 88 percent agreeing that online ads are helpful and important to their gift search.

While some brands already have established their own means of collecting first-party data, others are finding it more challenging to build a strategy to maximize their personalization efforts. Whether marketers are just getting started on the road to a cookieless future or already have data collection methods or loyalty programs in place, there’s no doubt that first-party data will transform the future of advertising.

Utilizing CRM tools has proven to be extremely powerful for a Mindstream client in the fitness space, creating efficiencies and making our ad targeting very precise. Using first-party data from the client, we can create lookalike audiences which profile a set of data points and target users who fit a certain threshold of attributes. We’re able to exclude consumers who are already in the brand’s CRM, eliminating waste, and we can also include consumers who have cancelled memberships, inviting them to come back to the brand after a set period. We can also retarget new customers for additional purchases, such as accessories for their initial purchase.

“Partnering with clients that provide access to their first-party data and key business insights is like a cherry on top for holistic media planning. It helps us create better integrated strategies and that drives better results for the client, so it’s a win for everyone,” says Mindstream Head of Integrated Digital Strategy, Meagan Cox.

Looking to 2022

As more campaigns shift toward personalization and improving the customer experience, we’re certain to see more convenience-related services, virtual brand experiences and consistent evolution of digital ad technology to catch the attention of consumers.

If your brand needs a partner to help improve your marketing effectiveness and fast-forward growth, please reach out to our team.

Source: Instacart

Source: Instacart