User-generated content (UGC) is a powerful component of any business’ digital marketing strategy. This can scare marketers, as businesses often have little control over UGC that comes in the form of ratings and reviews. Still, there’s no denying the impact of UGC; Ninety percent of consumers say user-generated content influences their purchases, and 53 percent say UGC is “extremely influential” or “very influential.” While no one can argue against the power of online reviews, review platforms and users alike will argue the ethical practices for garnering more reviews. As a result, industry-leading review platforms are taking steps to incentivize authentic reviews that customers can rely on.

Businesses must be aware of programs that incentivize real reviews because reviews can help build your brand’s authenticity, impact your online reputation, and ultimately, affect consumer purchase decisions. In this article, we’ll dissect three programs from industry-leading review sites that are designed to incentivize real reviews, as opposed to positive/negative reviews that were written as a result of bias or solicitation.

Google Local Guides

As Google expands the capabilities of Google My Business and Google Maps, the company has also given users the ability to provide much more than simply reviews and a star-rating. Google introduced the Local Guides program four years ago as a way to identify users who have “on-the-ground expertise and a commitment to sharing everyday experiences that informs real-time decisions across the globe.” The program has since grown to include 60 million Local Guides.

Local Guides contribute to Google Q&A, share photos, write reviews and update Google Maps information about places and businesses. Google will sometimes request specific content from Local Guides, such as pictures of food from local restaurants. Local Guides are rewarded for their contributions with points, status-levels, and in some cases, gifts.

Google continues to expand the program, recently incentivizing Local Guides to create public lists, such as, “My Favorite Places” and “Places I Want to Go.” Local Guides can now earn points simply for creating public lists of their favorite places.

Depending on how many contributions they share, Local Guides can rise up the ranks on levels from 1-10. The more points, the higher the rank. Local Guides who rank higher get special gifts from Google, including everything from 100GB of storage space to customized socks. Google also gives Local Guides early-access to new technologies, such as augmented reality walking directions within Google Maps. Google has turned the idea of reviews into a game for Local Guides – users are striving to achieve more points, or earn those additional badges. However, if a Local Guide’s review is reported as fake, Google will penalize that user by banning them from the program. So to be clear, Google is not using these incentives to encourage positive reviews; rather, they are incentivizing authentic reviews from verified Local Guides.

Yelp Elite

Members of Yelp Elite are the most active users of the review platform. They must write at least 40 quality reviews per year, have a detailed profile on Yelp, and continually interact with other members of the Yelp community. Once users achieve this level of activity, they can either nominate themselves for Elite status or be nominated by another Yelp user. After a user is nominated, their profile is reviewed by a Yelp employee, who can choose to add the coveted “Elite” badge to user’s profile.

Since Elite status is only given to users who have been vetted by a real Yelp employee, it’s not easy for users to con their way into Elite status. Elite status is also only good for one year, after which the user can re-apply for the program. Marketers can take advantage of the Yelp Elite program by personally inviting Elite members into the business location, or hosting an “Elite Event” open only to Elite Yelp users.

Business can find, identify and contact Elite members on Yelp. This can present problems, as Elite Yelpers who are invited to private parties by businesses might be more inclined to leave a positive review. Conversely, some businesses have actually punished Elite Yelpers who leave bad reviews, as was the case with this hotel that handed out fines for negative reviews.

Verified Purchases on Amazon

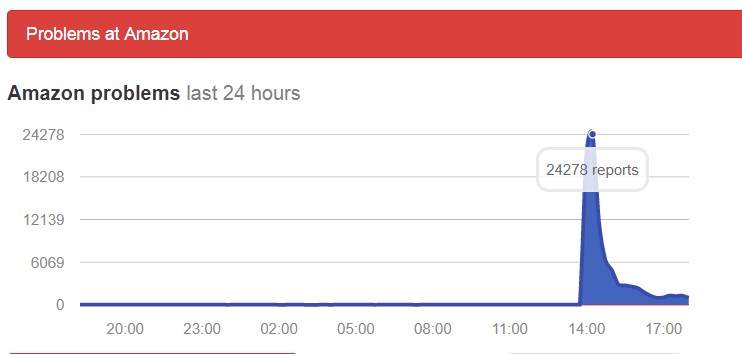

Customer reviews are serious business on Amazon. So much so that members of Congress recently wrote a letter to Jeff Bezos asking what he planned to do about fraudulent reviews.

The “Verified Purchase” is one way Amazon does attempt to verify authentic reviews. According to Amazon, this tag on a review means, “we’ve verified that the person writing the review purchased the product at Amazon and didn’t receive the product at a deep discount.” Amazon also updated their review algorithm to give weight to reviews with the Verified Purchase tag. A 5-star review with a Verified Purchase tag matters more to a product’s rating than a 5-star review from an unverified customer.

While Amazon has tried to use the “Verified Purchase” tag to identify authentic reviews, some outlets are reporting that this system is easily corrupted. In some cases, Amazon sellers can encourage customers to buy a product and leave a positive review, only to refund them for their purchase later on. To Amazon, it still appears as though the customer made a legitimate purchase and left a legitimate review. The Verified Purchase program isn’t foolproof, but it is a step in the right direction in Amazon’s efforts to ensure review authenticity.

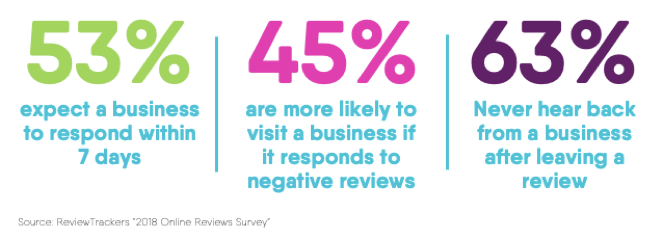

All marketers want more reviews, but since each review platform has strict guidelines against incentivizing users for reviews, best practices must always be considered. And while platforms are offering incentives for authentic reviews, none of the programs mentioned in this article are foolproof, but each program is part of an ongoing effort by review platforms to help customers and businesses by eliminating fake reviews. Marketers can do their part by responding to all reviews and asking for more information on negative reviews in order to determine the cause behind the review in order to make proactive changes to their business. The challenges that come with online anonymity may prevent review platforms from ever eliminating all fake reviews, but each of these programs is a positive step towards review authenticity.

Need help staying on top of reviews? Contact Mindstream Media Group to find out how our local social marketing solutions can amplify your brand’s presence.

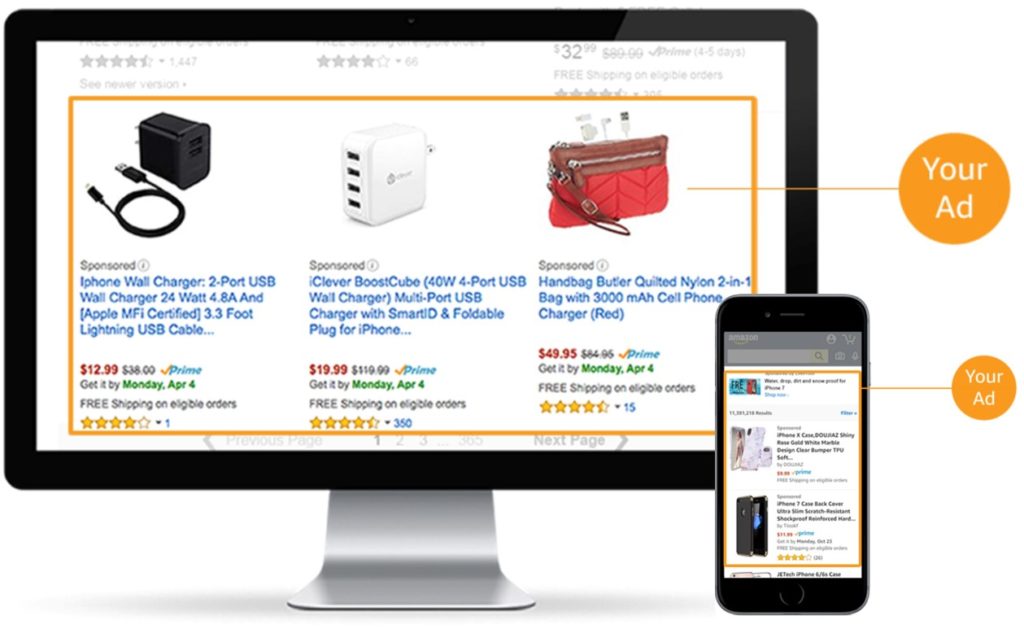

Using predictive data from past purchases and real-time shopping insight, AAP serves up arguably the most relevant advertising at the time of decision. This puts advertising across Amazon’s owned-and-operated sites and apps at the bottom of the funnel.

Using predictive data from past purchases and real-time shopping insight, AAP serves up arguably the most relevant advertising at the time of decision. This puts advertising across Amazon’s owned-and-operated sites and apps at the bottom of the funnel. Advertising options are plentiful across the sites, which include IMDb and Amazon Prime Video, as well as third-party exchanges. By 2022,

Advertising options are plentiful across the sites, which include IMDb and Amazon Prime Video, as well as third-party exchanges. By 2022,