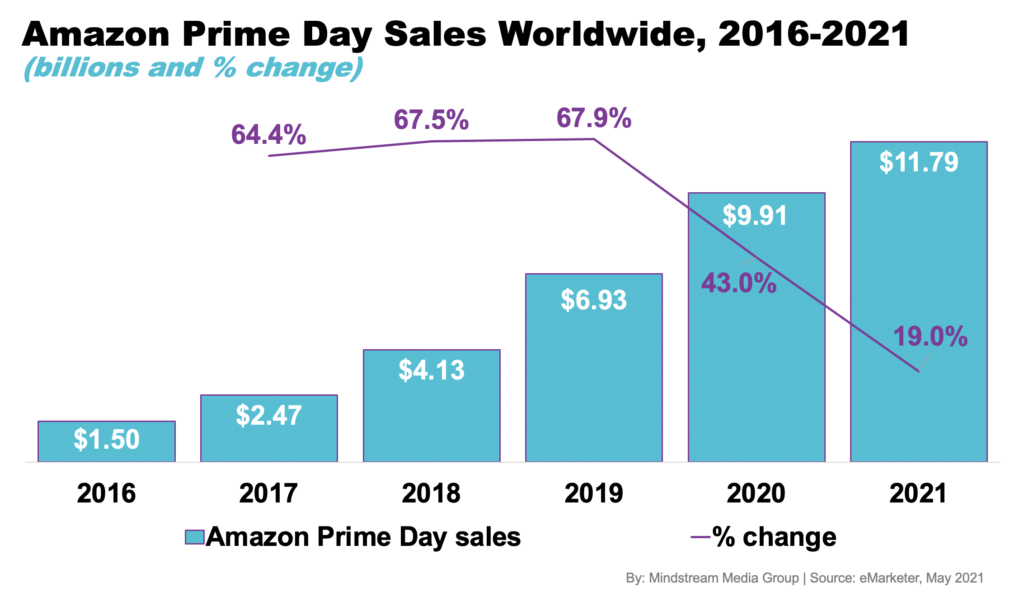

My favorite season is upon us and while shoppers prepare to snag the best deals, retailers are preparing for their biggest year yet. Amazon’s 48-hour Prime Day event kicks off on June 21 and sales from the promotion are expected to approach $12 billion worldwide. While annual growth will be slower again this year, Prime Day 2021 will still smash last year’s sales record by nearly $2 billion.

eMarketer laid out their outlook:

- In 2021, U.S. ecommerce sales across all retailers during the Prime Day sales event will grow by 17.3% year over year to $12.18 billion, per our estimates. That’s an increase of almost $2 billion in spending compared with 2020.

- We expect Amazon’s share of U.S. ecommerce sales during Prime Day to stay almost the same this year as last year, despite competition from other retailers.

- U.S. ecommerce sales on Amazon will account for 60.0% ($7.31 billion) of all U.S. retail ecommerce sales during Prime Day 2021, compared with 59.4% ($6.17 billion) during Prime Day 2020.

What’s Different

As if 2020 and 2021 weren’t upside down already, Prime Day is moving up in the retail calendar from traditional mid-July timing to late-June which is likely to find shoppers in a summer state of mind. As a result, forecasts are estimating higher sales in summer apparel and gear for outdoor activities. However, it could also prompt an earlier start to the back-to-school shopping season with forward-thinking college students and parents getting a jump start on supplies shopping.

While the focus of Prime Day sales might be on an apparel and outdoor goods, “revenge shopping” is likely to enter the equation as well. The newly coined term has been used to describe a rush of post-pandemic discretionary spending and could result in a boost to luxury brands and nonessential product categories. Although the pandemic is still a factor, the impact this year will be from the release of pent-up demand for products not purchased as a result of lockdowns and restrictions.

Amazon is also giving small businesses on the platform a boost by offering additional exclusive promotions. Prime members can now purchase from over 300,000 small business sellers worldwide and get a $10 credit from Amazon to use during Prime Day.

Amazon Domination

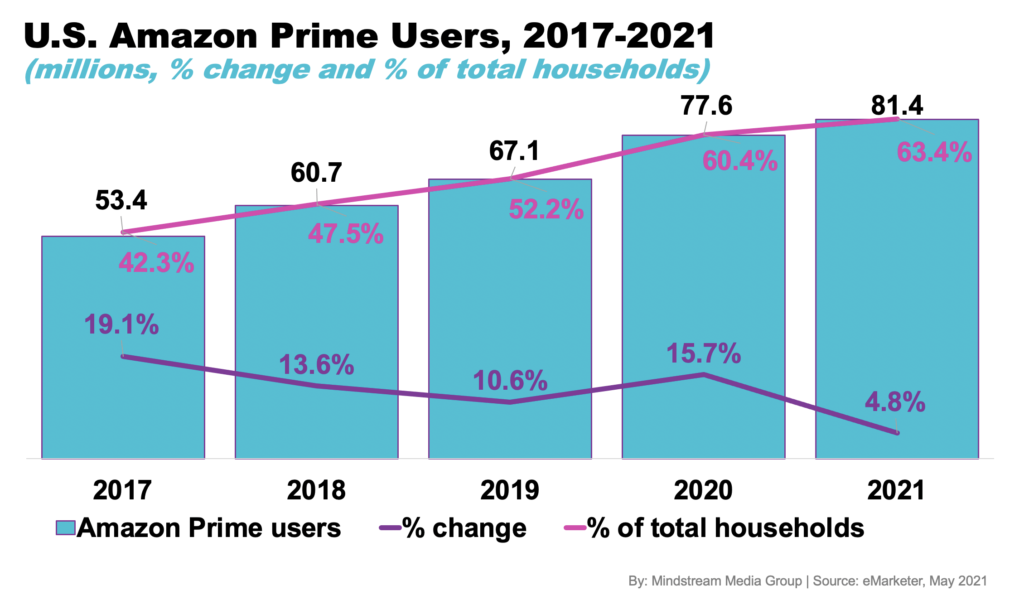

A whopping 60.4 percent of U.S. households were Prime users in 2020. After a 15.7 percent increase in membership last year, subscriptions are expected to grow just 4.8 percent in 2021 bringing the total to 81.4 million households.

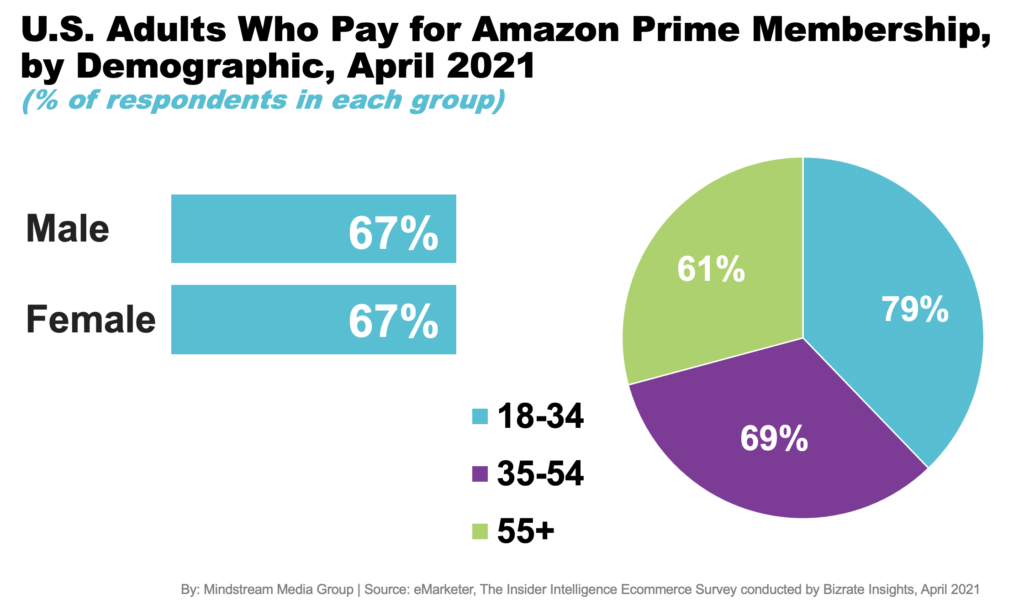

What’s noteworthy here is the increase in the younger demographic flocking to the ease and allure of Prime membership. According to an April 2021 survey conducted by Insider Intelligence and Bizrate Insights, 79 percent of U.S. consumers ages 18 to 34 said they were Prime members or someone in their household was a Prime member, compared with 69 percent of consumers ages 35 to 54 and 61 percent of consumers 55 and over.

Although competing retailers like Walmart and Target will have deals of their own during the Prime Day window, Amazon will continue to dominate sales. In fact, the ecommerce giant is expected to rake in $7.31 billion or about 60 percent of all U.S. retail ecommerce sales during the Prime Day event.

One thing is clear, Prime Day offers tremendous opportunities for brands and consumers alike. In addition to its ecommerce platform, Amazon has also secured its stronghold in the advertising landscape and is the third-largest ad seller in the country. At Mindstream Media Group, our Amazon Certified Programmatic Traders help clients maximize return on ad spend with programmatic display, audio and video ads placed through the Amazon DSP. Click here to learn more about the platform and how we can help.

Contributed by Meagan Cox, Senior Media Planner. As much a strategic thinker as a certainty to make you laugh, Meagan knows the ins and outs of digital and traditional media, is consistently contributing to client growth and can transform an otherwise business-as-usual discussion into a joyous occasion by adding in her own unique brand of humor.