The pandemic’s impact on advertising budgets and strategy has been significant over the last several months, causing understandable and cautious shifts as brands navigate the evolving landscape. And while COVID continues to disrupt life as we knew it before, we can’t forget about another looming factor that will impact our media and economic climate – the U.S. presidential election.

Now that we’re in the political advertising window (September 4 – November 3, 2020), what do advertisers need to be aware of and consider in regard to their media strategy?

In this article, we’ll provide research and insights from our team on how the next couple of months could be impacted by political advertising.

When approaching this topic, we started with the IDEA framework, as we do with other Mindstream Media Group strategies.

IMMERSE: We looked to the past and what we know about the current climate.

DEFINE: We explored the importance of assigning value to media. If you didn’t measure it, did it even happen?

EXECUTE: We determined how quickly media can be launched or pulled, should an opportunity or threat present itself.

AMPLIFY: We summarized what we believe it takes for brands to win during political advertising season.

The Political Media Landscape

Political investments are expected to surpass $6 billion easily and could reach as high as $10 billion. That means there may be media supply issues, which would likely impact cost and also our decision to pursue certain media channels for our clients.

Let’s talk about what that means for our investment in media.

Digital CPMs

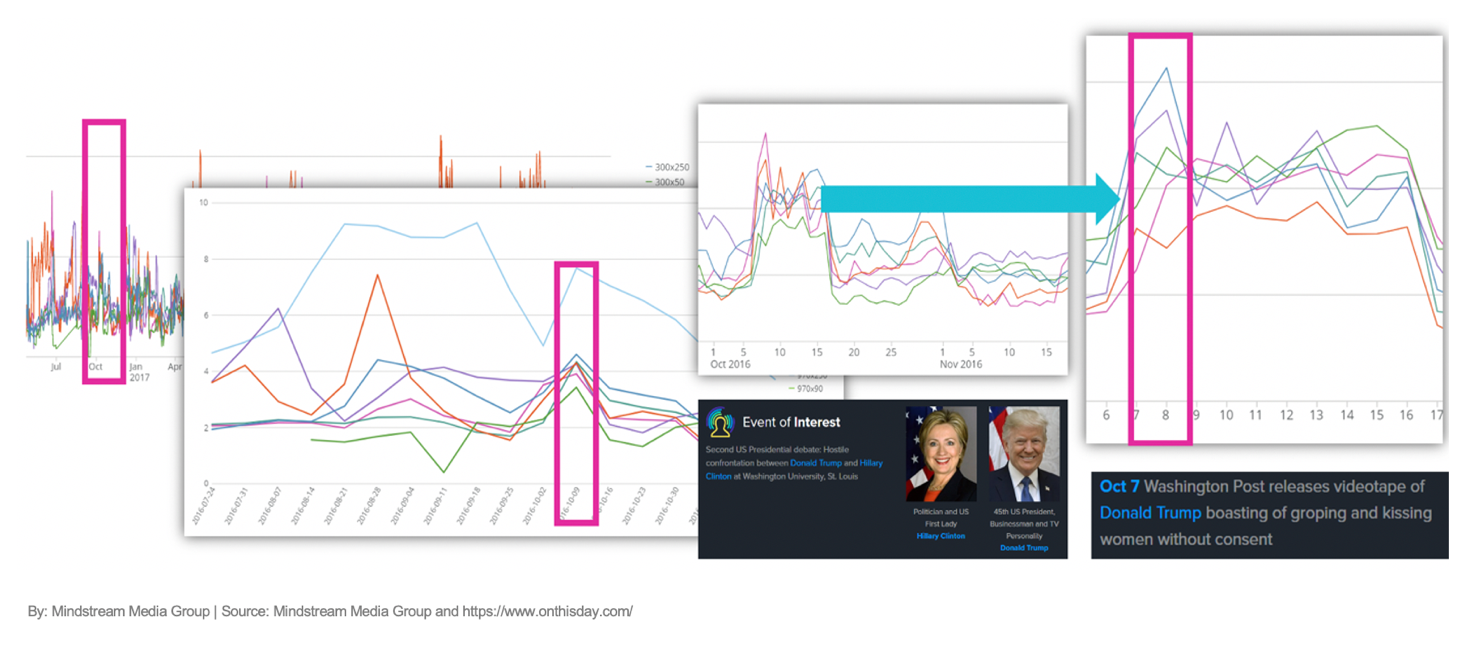

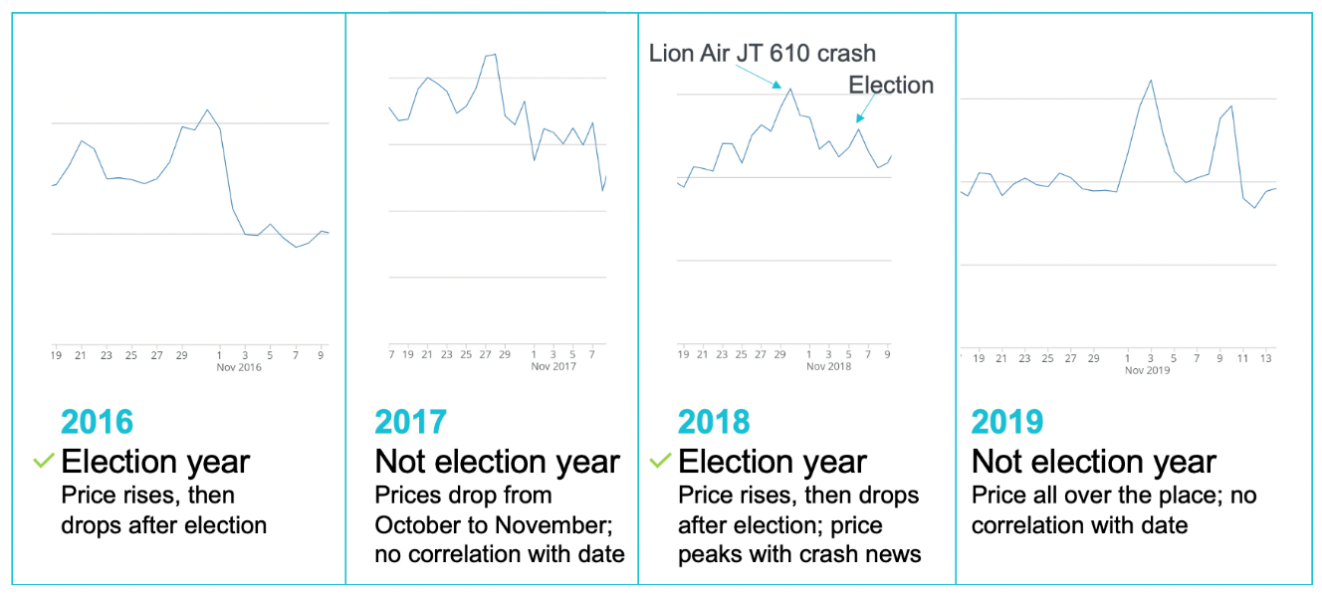

Looking at the last four years of data on digital CPMs – starting with the 2016 presidential election, there’s been a steady rate increase representative of inflation, more advertisers investing in digital and more digital placements and sites available.

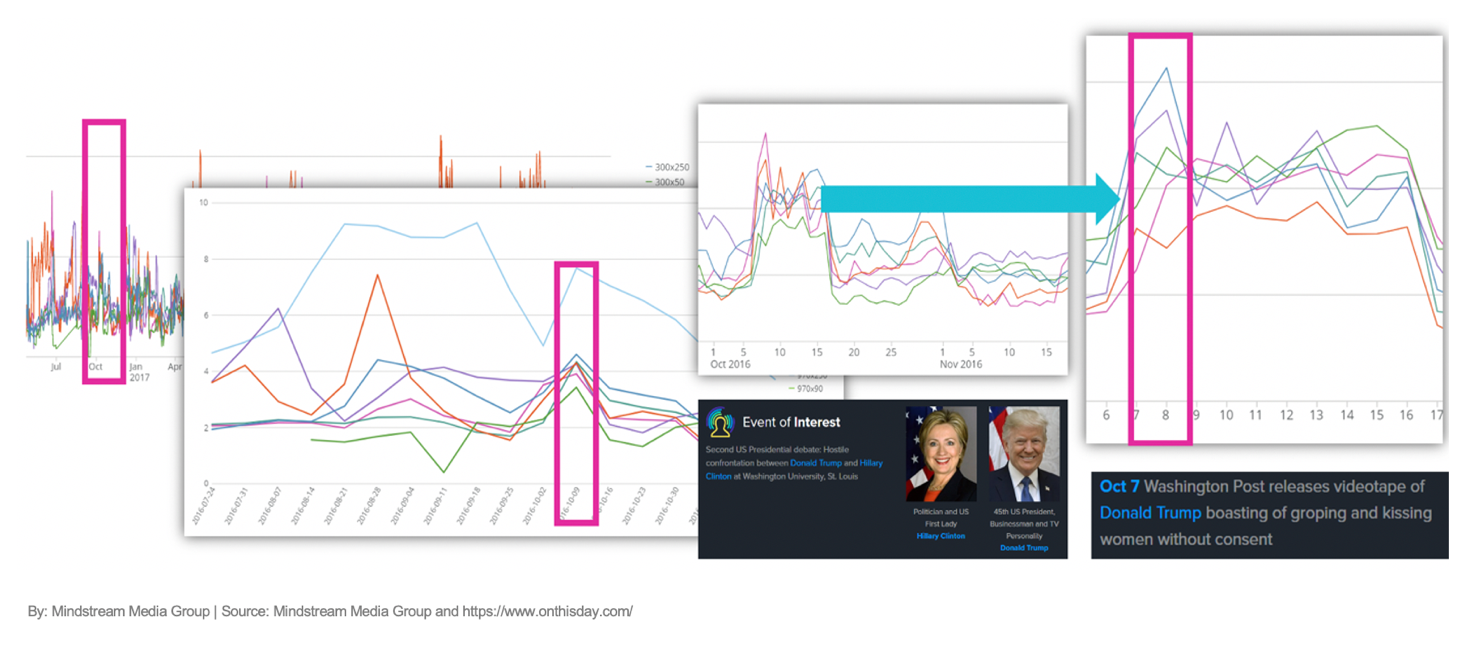

2016 Presidential Election Window

During the election window in 2016, the first week of October showed a spike in digital CPMs. That was, of course, the week of the contentious second debate between Hillary Clinton and Donald Trump, and the same time that a controversial news story broke about Trump. Average CPMs were higher during this week than during the actual election week in November.

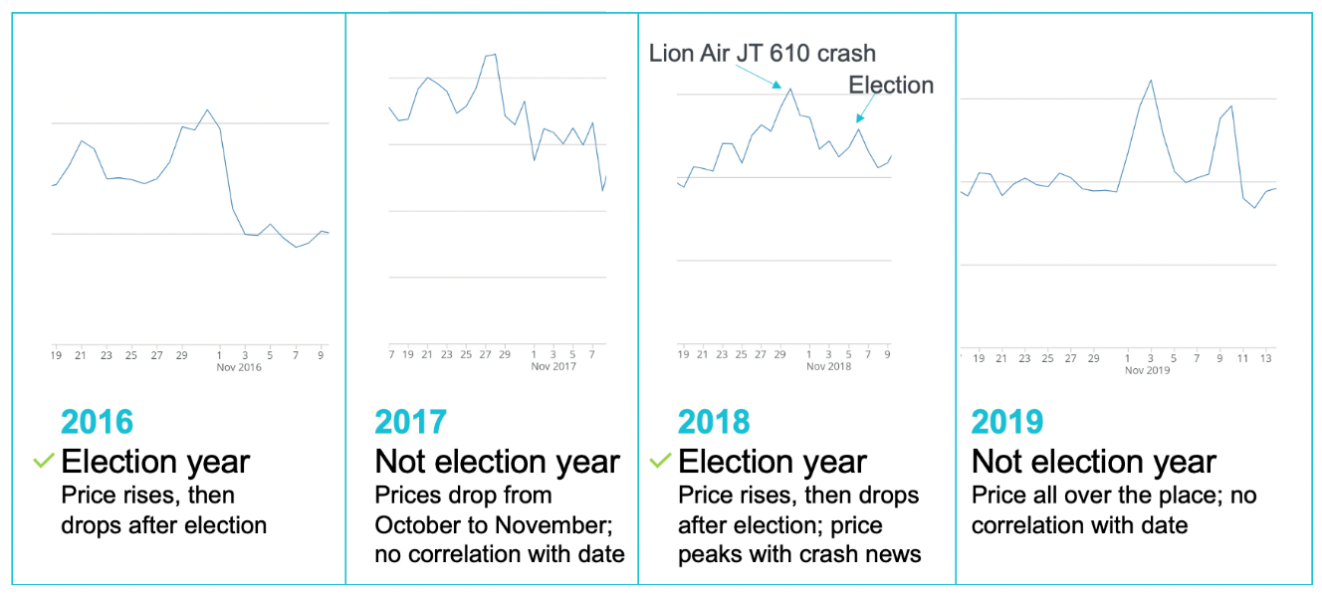

Election Year V. Not

Of course, we can’t just look at one year – we have to compare October/November CPMs to non-election years as well. There are certain correlations between CPM and election windows, but why is that? The short answer is, more news drives more consumption, which increases demand, which in turn, increases ad price.

What’s the lesson here? Large news events leading up to the election window itself, even weeks out, have just as much or even more bearing on media impact. We can’t predict when the next leak or big story will happen, but we can prepare for it.

Television is Similarly Uncertain

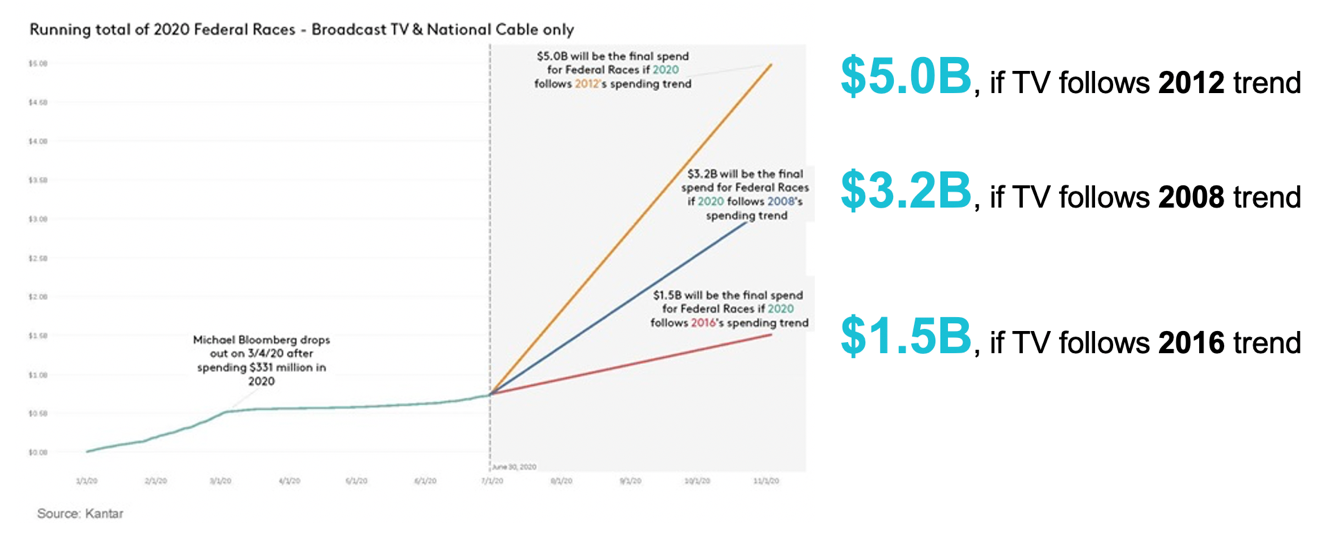

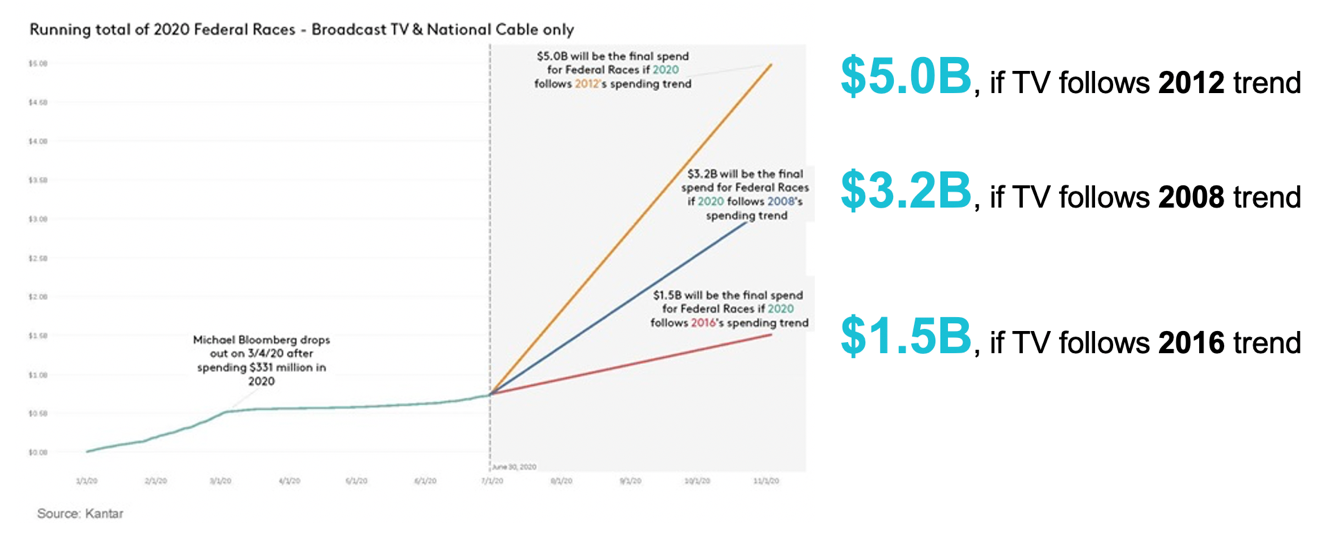

Similar to digital, we’ve already begun to see political TV spend take off, but spending projections are all over the board. Political spending is always fairly uncertain, which in 2020 will ring especially true.

According to Kantar research, Broadcast TV and National Cable projections for 2020 range from $1.5 billion (if following the 2016 trend) up to $5 billion (if following the 2012 trend). That’s a huge projected range, but in general, we can expect a five to ten percent increase in TV CPMs.

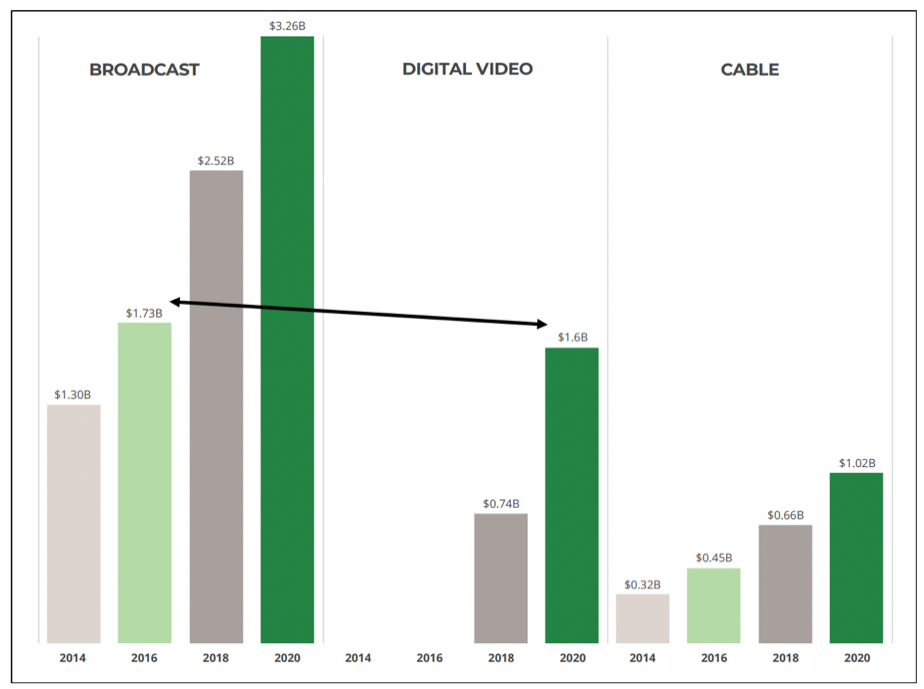

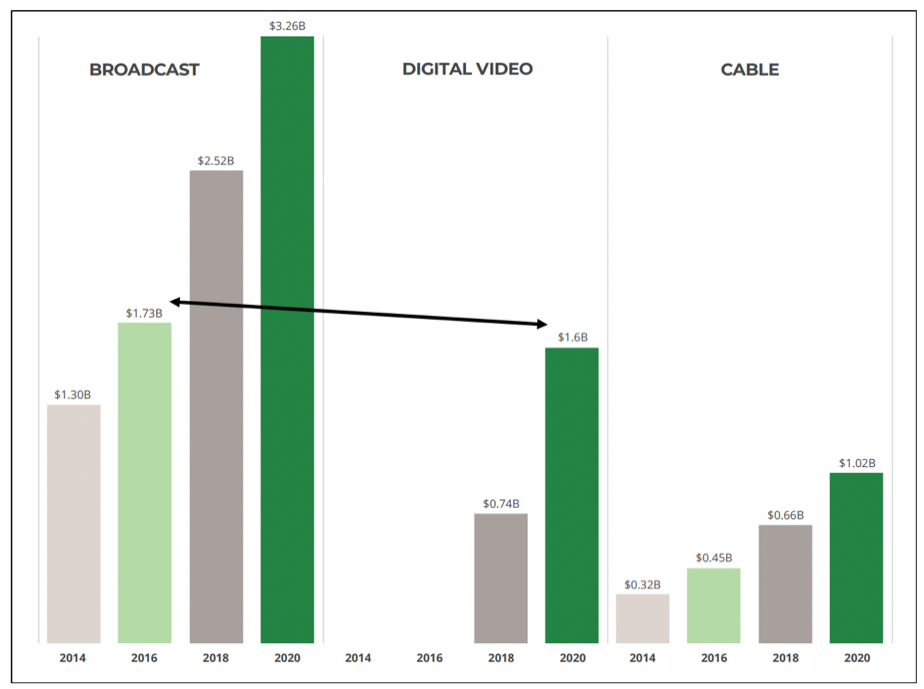

2020 Political Spending on Video

2020 spend on TV advertising alone is projected to be 88 percent higher than during the 2016 presidential election and 30 percent higher than the 2018 midterm election.

Streaming video is shaping up to be the future of political advertising. With multiple platforms, better geographic and demographic targeting and huge, consistently growing viewership, 2020 spend has more than doubled since 2018. This year, digital video is on par with the 2016 broadcast level, and we can only expect to see it rise exponentially for the next election year.

A Political Election, in COVID Conditions

Think of all the major events cancelled this year – events that would have drawn media dollars from the world’s largest brands. It’s important to know that the channels with limited availability (like broadcast TV and radio) will be under even more pressure during this window, given the revenue catch-up game in play. Remember that projected TEN BILLION DOLLARS?

Remarkably, our research shows that from a political media buying perspective, only two channels were seriously injured by COVID: out-of-home (OOH) and experiential. This was for obvious reasons, too – we were asked to stay in our homes and of course, not experience anything, with anyone. In a typical election year, OOH and experiential ads are a large part of political campaigns, but since there are less drivers on the road, initially due to shelter-in-place orders and now due to the work-from-home boom, billboards aren’t as much of a priority.

It’s a shame not many will actually see this billboard – that’s good creative!

While OOH also includes bus shelters, benches, elevators, airport terminals, transit stations, cabs, buses, gyms, movie theaters, shopping centers, etc. in addition to billboards – those are also ALL locations where there’s been a huge decrease in foot traffic, and in turn, less eyeballs likely to see the advertising message.

Experiential marketing was the hardest hit, as political events and rallies were postponed or cancelled due to COVID restrictions. And although the candidates have shifted those in-person events to online events, both attendance and audience engagement have suffered tremendously.

What Will We Get for Our Investment?

Sales data is powerful. If you can’t measure it, did it really even happen?

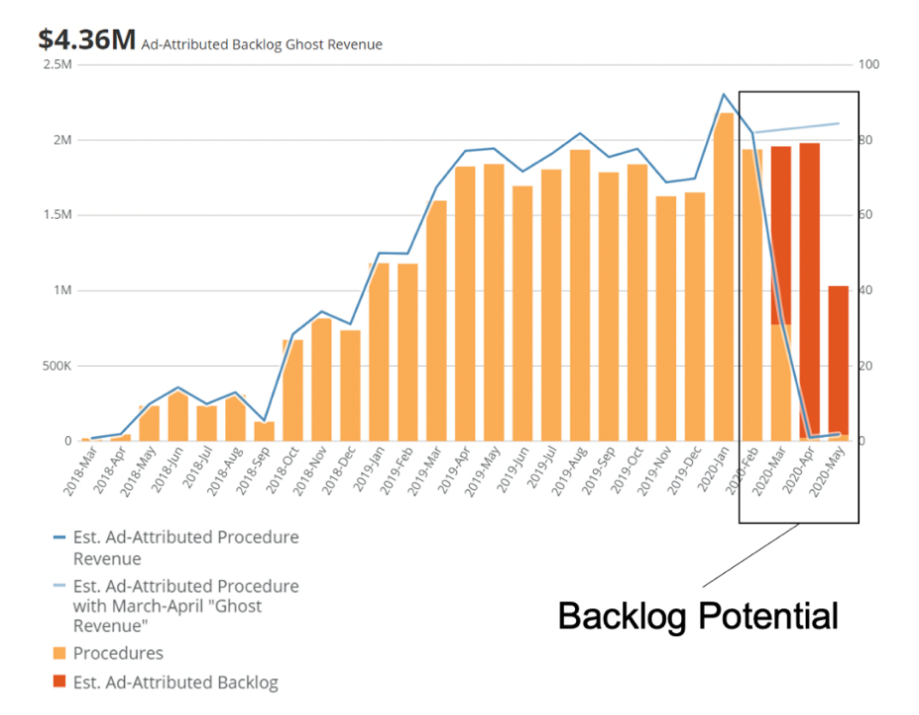

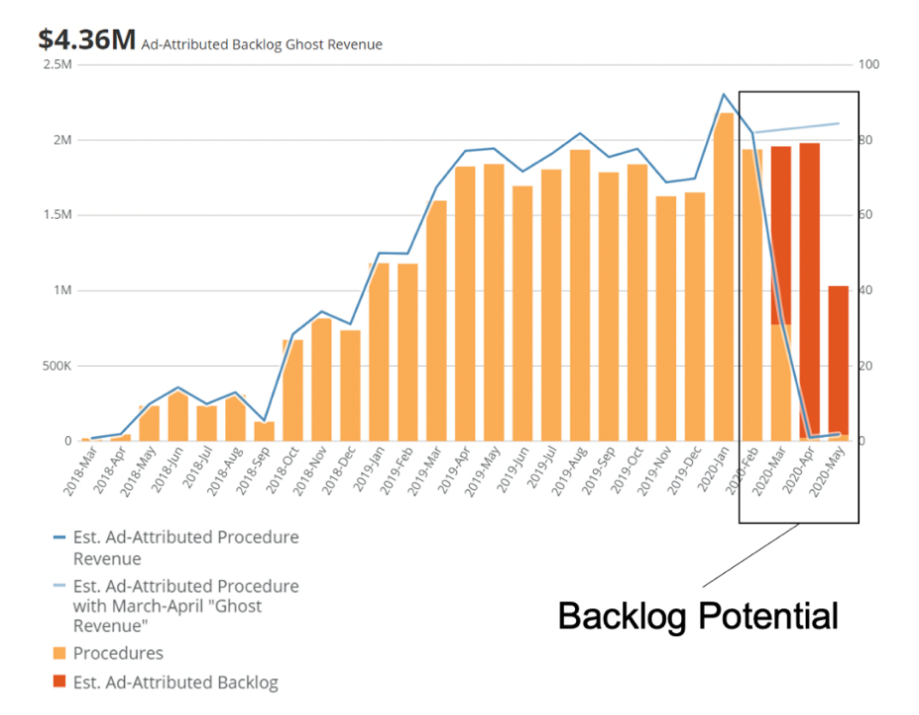

Now more than ever, media must fight harder to break through all the noise, especially during the airing of political ads. It’s critical to measure what we get from that fight. With a hospital client, for example, we developed a growth formula – the “what would have been if it weren’t for COVID” scenario. We couldn’t have arrived at this formula without key revenue data from the client. From this, we developed a strategy to directly target the “backlog,” those looking to have elective procedures performed.

And if that’s not hard enough, per FCC regulations, political ads get precedence, meaning other advertisers could get bumped.

COVID has impacted sales in a huge way for many brands and clients, and this example illustrates a strategy aimed at recovering revenue lost to facility closures – which could not have been enacted without the sales data to inform the strategy.

Agility is Key During a Political Window

The good news is, we have options, but they require an agile planning and buying workflow from the beginning. Select digital tactics offer alternatives in short order. For example, a TV alternative may be connected TV, while for radio it may be podcasts or streaming audio.

As an agency, we have ideal and emergency campaign setup windows outlined, and while more lead time is always better, the takeaway is that we can move fast or shift channels if we need to. Agility is key.

General Election Basics

As we enter the 2020 general election window, keep these political advertising basics in mind. They affect all types of media and all advertisers.

- Candidates (federal, state and local) can purchase ads at the lowest unit rate given to any political advertiser.

- Media stations can limit political inventory, but also must provide reasonable access to it.

- All dayparts must be made available.

- Stations can limit or exclude inventory in news programs.

How Brands Can Win (or, Not Lose)

With the volatility of the political advertising season, some brands may choose to avoid October altogether. With the right strategy (and media partner) though, the volatility can be minimized and planned around. Some considerations include having one strategy for “toss-up” states versus “safe” states, diversifying the media mix to plan for political preemptions and adopting an agile reinvestment plan to create flexibility.

Takeaways to consider:

- All media will be affected by political ads.

- A state-by-state or regional variation in media strategy must be taken into account versus a national campaign.

- Agility is key in navigating the political advertising season.

- A media partner with nationwide buying power combined with local market expertise is a brand’s best bet to maximize efforts.

- Embrace a multi-channel approach to reinforce your message.

In this ever-critical lean-burning time where media is under increased scrutiny, it’s important for us to show that a brand’s media mix is effectively reaching the target audience. Building agility into the strategy will help our clients win.

![[Video]: Utilizing Data to Gain Efficiencies and Uncover Opportunities](https://mindstreammediagroup.com/wp-content/uploads/2020/09/Utilizing-Data-scaled.jpg)

![[Video]: Accelerating Sales with Shopper Marketing](https://mindstreammediagroup.com/wp-content/uploads/2020/09/GettyImages-842785478-scaled.jpg)