[Case Study]: Redefining CPG Media Mix for Immediate Growth

Mindstream Media Group has successfully partnered with CPG brands to develop local market media plans designed to measure the impact of strategic paid media elements on overall brand awareness and sales lift. This experience and unique perspective were leveraged to create a media mix strategy for a national kitchen and laundry appliance cleaning product brand.

Overview

The client’s previous approach to media was broad in structure and did not lend itself to observable test and learn scenarios, which is key to identifying and proving media mix effectiveness. We revised the setup of targeted media and implemented a carefully outlined, multi-market exposed versus control media channel delivery strategy. The result showed a large lift in year-over-year sales and armed us with insights for driving even greater returns with future campaigns.

Challenge

Increase brand awareness of and sales for a CPG brand amidst a stacked roster of brands in the cleaning product category.

Objectives

Modify the existing mass reaching, national approach of media delivery into a pinpointed selection of markets in order to measure and verify:

- sales of core products

- media channel value and opportunity for progressed application

Approach

Mindstream Media Group’s initial collaboration with our client involved mapping out historical sales data to visualize product sales by DMA. Once complete, we added retailer store count and population density per DMA to gain a better understanding of the opportunity landscape of each market. Test and control markets were then defined based on this data.

The test included 12 DMAs that were segmented into three groups (Control, Market A, Market B). Segments were grouped together based on Q4 2018 sales volume and DMA population density relative to the number of retailers within those DMAs. Within each group, there were also high, mid and low investment DMAs.

Market A and B segments were exposed to a consistent base media channel mix focused on new customer prospecting and re-engaging users at various touchpoints along the path to purchase. DMAs in Market B were assigned a variable media outlet/channel partner and had specialized delivery against them with an opportunity to engage users via this additional touchpoint. The contribution and return of this channel partner were assessed by online ROI reports and the effect on retailer sales within supported markets.

Control markets were supported only by national paid search efforts. All other media delivery was withheld to establish baseline market references for general year-over-year sales trends and the impact of media support versus none.

The goal of the test was to assess how media impacts sales growth of brand products and whether a certain media mix had a greater impact over others. Sales of three of the brand’s appliance cleaning products (for washing machines, dishwashers and disposals) were tracked relative to the following media channels:

- Display

- YouTube

- Paid Social

- Paid Search

- Dynamic Digital Retail Partnerships

Hear more about how we proved the true efficacy of media and leveraged shopper marketing to boost sales.

Results

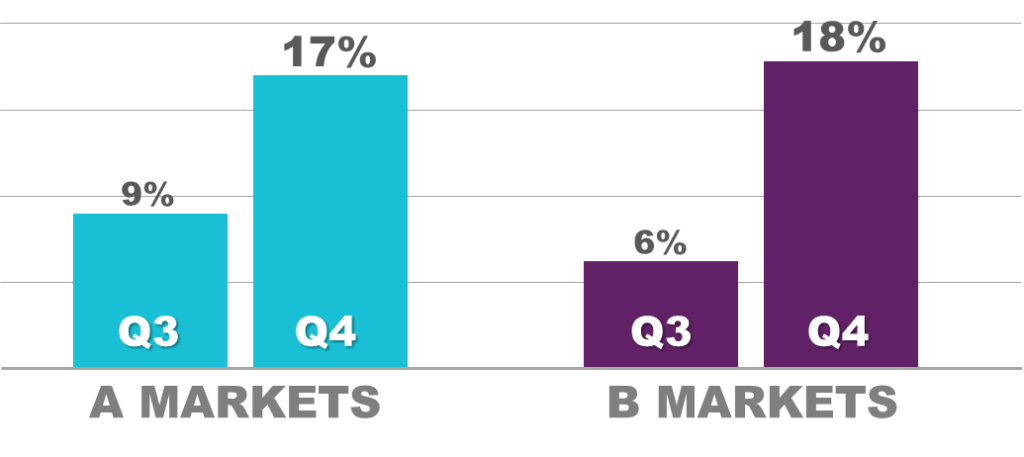

Both test groups showed a significant lift in both quarterly and year-over-year sales (2019 Q3 vs Q4 and 2018 Q4 vs 2019 Q4). Our first quarter of media partnership revealed an 89 percent lift in sales in A Markets and a 200 percent lift in sales in B Markets quarter-over-quarter.

A Markets – Q3 2019, 9% lift YoY / Q4 2019, 17% lift YoY / 2019 QoQ, 89% lift

B Markets – Q3 2019, 6% lift YoY / Q4 2019, 18% lift YoY / 2019 QoQ, 200% lift

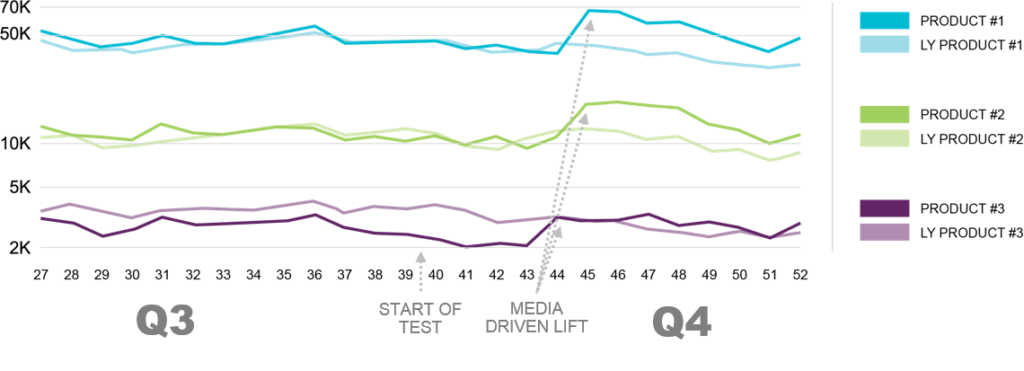

A media-driven lift was visible in all three of the brand’s core appliance cleaners supported in the test:

- Product 1 = Washing machine cleaner (65 percent budget allocated to support)

- Product 2 = Dishwasher cleaner (20 percent budget allocated to support)

- Product 3 = Disposal cleaner (15 percent budget allocated to support)

*LY = Last year *TY = This year

More from Mindstream Media Group

Meet the Mindstreamer – Chandler Swanner

Chandler Swanner’s interest in advertising dates back to her childhood. Her mother (and role model in life) was a Media […]

Third-Party Cookie Phase-Out: What Marketers Need to Know

Cookies are an essential part of internet usage, allowing websites to remember you and provide a more personalized experience. This […]

Meet the Mindstreamer – Kaya Bucarile

She plans and oversees media strategy for agency clients, working closely with project and platform managers to ensure that we […]