Let’s talk about a massive advertising opportunity that has been flying under the radar for a lot of advertisers. It’s not that advertisers have ignored this opportunity, it’s more that they don’t really understand it. The opportunity we’re talking about is native advertising – a misunderstood format with serious potential for brands.

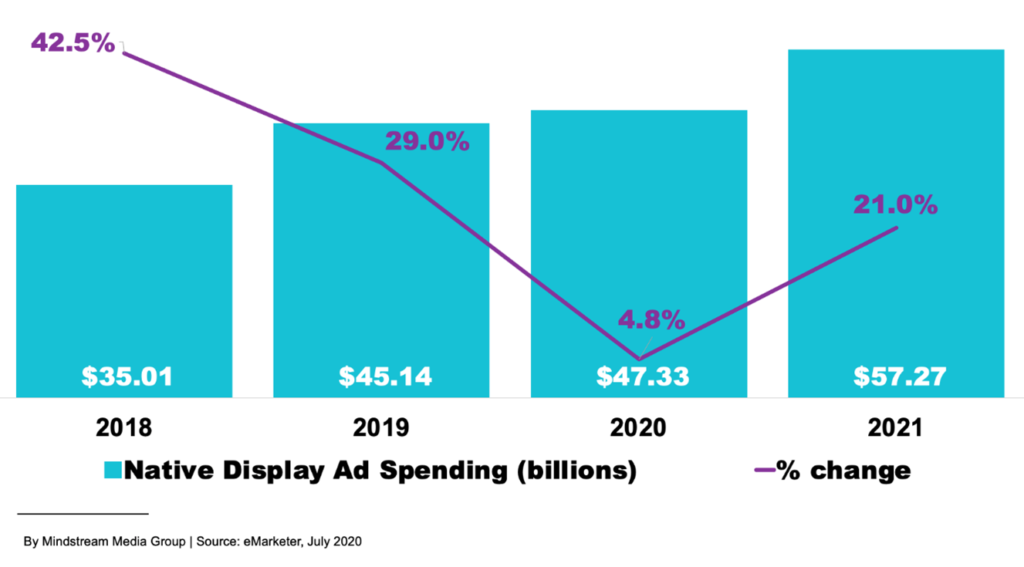

In 2021, U.S. advertisers will spend over $57 billion on native ads, which represents almost two-thirds of all digital display spending. In other words, it’s a pretty big deal. Still, even in the marketing and advertising worlds, not everyone is 100 percent sure what native advertising even means or what types of ads fall under its umbrella.

Some of that uncertainty lies in the nomenclature. When someone says “TV commercial” or “paid search ad” it’s fairly simple to figure out what they mean. But “native advertising” isn’t as intuitive. So, let’s take some time to peel back the layers of this [native advertising] onion and help marketers like you understand how to incorporate native advertising into your Q4 2021 and 2022 media strategy.

What is native advertising?

Let’s start with a softball question: what is native advertising? Here’s a simple definition from our friends at eMarketer:

“Digital display ads that follow the form, feel and function of the content of the media on which they appear, be it a webpage or an app.”

The key to native advertising is its non-disruptive nature. Ads don’t really look like ads; they integrate so smoothly with the page content and design they feel natural or “native.”

What do native ads look like?

Native ads come in several formats and on a variety of channels and platforms. Here’s a look at some of the more popular native ad formats.

In-feed ads

In-feed ads are paid social media posts that display in users’ feeds along with organic posts, usually with the denotation “Promoted” near the top of the post.

Sponsored content

Sponsored content includes ads for online articles, blog posts and other content pieces that show up in the sponsored content section on publisher sites (typically below an article from that publisher).

In-app reward videos

In-app reward videos appear in mobile apps and reward users for watching (e.g., Pandora videos that offer extended periods of uninterrupted listening after users watch them).

How can I use native ads in my digital media strategy?

For creative advertisers, native ads offer plenty of opportunities to drive results throughout the consumer buying journey. The key is focusing on your target audiences’ needs, demonstrating how you provide value to those audiences and building purposeful campaigns. After you lock in those three components, it’s a lot easier to decide which formats to use.

Focusing on your target audience

Before you start building your campaign, make sure you have a clear idea of the types of consumers you’re trying to reach. Conduct in-depth research into your target audience to figure out their needs and wants, what media channels they frequent and how they prefer to interact with brands.

Demonstrating your value

Once you understand your audiences, identify how your products and services address their needs. Your ad messaging should center on that value proposition in a way that resonates with specific consumers.

Building campaigns with a purpose

Ask yourself “what specific results do I want native advertising campaigns to drive for my brand?” Make sure your team understands what you’re trying to accomplish and the metrics you plan to measure success against.

What does the future have in store for native advertising?

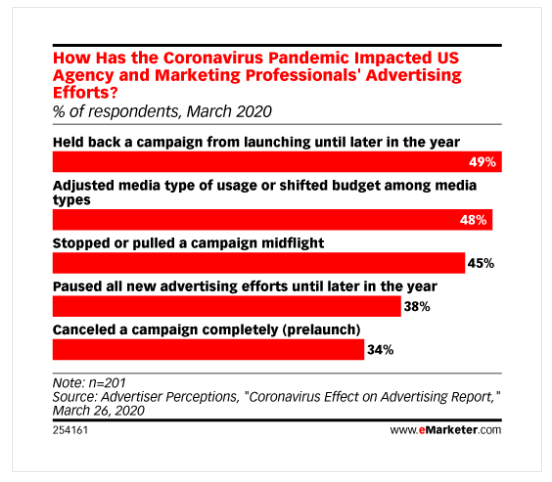

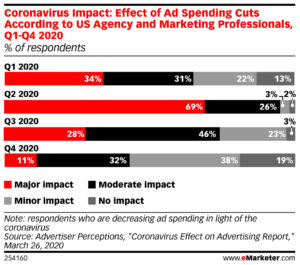

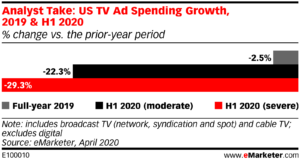

2021 is already a huge year for native advertising. Despite slower growth in 2020 due to the pandemic, native ad spending grew by over two billion dollars in 2020 and has increased by over 22 billion since 2018.

U.S. native digital display ad spending

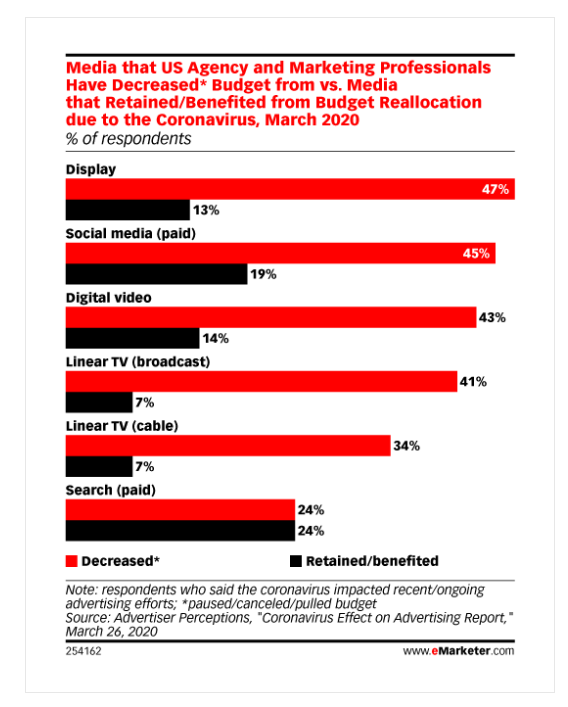

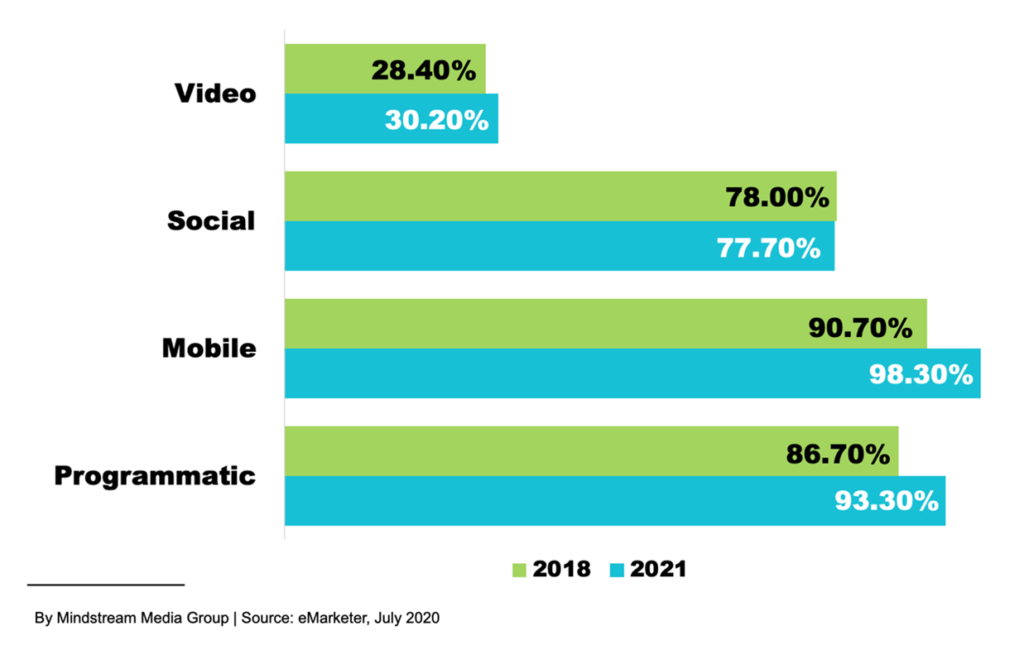

Mobile channels, programmatic platforms and social networks are the main drivers behind this increase. And, since there’s a lot of overlap between the channels, there are plenty of opportunities to run campaigns that incorporate all three.

Native ad formats like video and sponsored articles are becoming more popular as well, which has taken a chunk out of social media’s share of the ad spend. But social ads will still account for around three-quarters of native ad spend in the foreseeable future.

Percentage of native ad spending

There’s also a lot of growth happening in native advertising. Ad tech companies are building out the infrastructure necessary to handle large-scale programmatic native advertising campaigns that have:

- The ability to test multiple creative messages

- More sophisticated audience targeting

- Better tracking and measuring capabilities

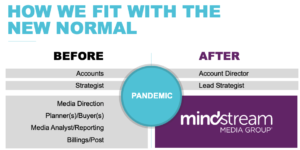

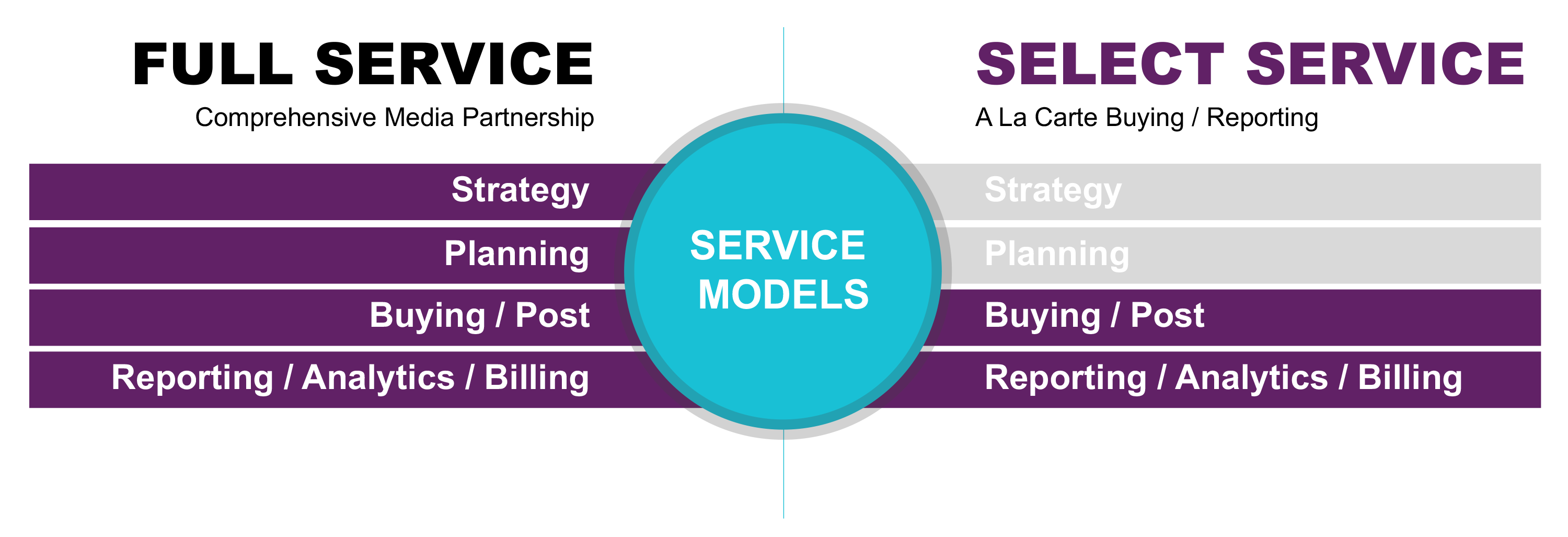

For brands, this means the already warm waters of native advertising should heat up even more with increased engagement and higher conversions. If your brand is interested in diving in, contact Mindstream Media Group to learn how our native advertising solutions can help Fast-Forward Your Business.

Editor’s note: This post was originally published in March 2019 and has been updated for freshness and accuracy.

![[Case Study]: Redefining CPG Media Mix for Immediate Growth](https://mindstreammediagroup.com/wp-content/uploads/2020/08/GettyImages-1129667981-scaled.jpg)