Leveraging the Industry’s Top Research Tools

As an agency, Mindstream Media Group invests over $1 million annually in the media industry’s best research, intelligence and analytics tools, which help to define and drive our media recommendations, as well as help our agency partners flourish.

Whether we are forming a comprehensive media partnership with another agency or working as a consulting partner for services like media buying, reporting or analytics, we’re able to leverage these valuable industry tools to guide and inform our strategies and maximize success for all parties involved. Our agency and client partners rely on us, as well as our tools, to answer challenging questions and propel their brands forward.

In some instances, we’re filling the gap for agency partners that have found themselves with limited media and research capabilities after the last year of possibly shifting or reducing resources.

While all of our tools like Nielsen, SQAD, eMarketer, SEMRush and Comscore provide value to our clients and partners, the top three that we use most are Kantar, Pathmatics and MRI-Simmons.

Here’s a closer look at each.

Kantar

We rely on Kantar to gain insight into the competitive landscape from a directional sense on where brands are spending across traditional and digital media. Kantar is an advertising intelligence tool that helps our clients’ creative, paid, owned and earned media be more effective. With the ability to research competitive activity and spend, including traditional (TV, radio, print and OOH) and some digital spend, as well as view competitive creative placement and assets, Kantar allows us to measure and optimize the effectiveness of content and activity across all media channels and provides actionable insights to improve performance. We are also able to understand how and where consumers are seeing client and competitive content and gain insight into how each channel impacts the brand, market share and sales growth.

Kantar helps advertisers stay ahead of the competition by giving access to industry spend and media mix trends, the ability to view and analyze competitive brand investments and evaluate creative messaging strategies. Kantar also helps brands understand their own campaigns’ performance to help gauge and optimize omnichannel strategies.

Source: Kantar

Recently, Kantar used analytics to determine what consumers expect from brands in regard to the social justice and human rights movements. By conducting contextual research on personal values and actions, and combining that with Kantar’s artificial intelligence tools, they were able to identify consumer trends related to their personal values. They found “demand for values showing momentum including bravery and improvement, while actions such as donations, supporting black-owned and anti-racism are likely to disrupt.”

At Mindstream Media Group we use Kantar in developing RFPs, client media planning and for identifying agency growth opportunities, as well as to aid clients with their own projects. MedStar Health, a hospital system based in the Northeast U.S., inquired about a recent competitive ad that had just started running on TV. Since TV data as recent as two days prior is available in Kantar, we were able to quickly identify and view those ads, find out when and where they started running, how many times they had run in each market, as well as pull the spend data, thus aiding in determining the competitive messaging strategy. We were then able to provide a more detailed competitive overview back to the client.

Pathmatics

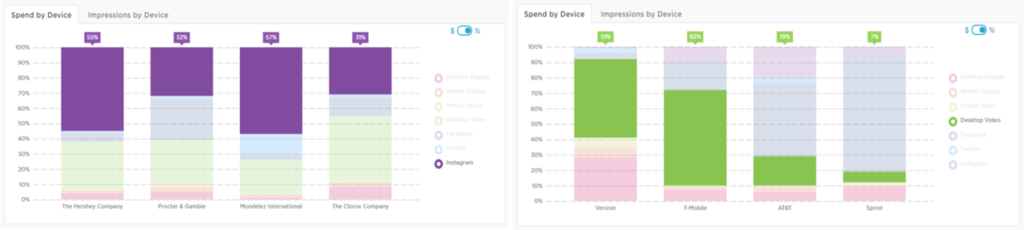

Recently acquired by Sensor Tower, Pathmatics is a suite of marketing intelligence tools that help our team better understand the marketplace to identify key opportunities for clients. It allows us to get an idea of spend by brand and shows how creative messaging changes throughout the year. This has been especially helpful given the challenges using the right voice and messaging to resonate with consumers throughout the pandemic. Pathmatics allows us to create data-driven digital marketing strategies based on marketplace trends, competitive spend, messaging and budget allocation.

Pathmatics’ competitive spend tools for digital media provide robust insight into the most difficult to track ads like targeted and retargeted, mid- and post-roll, click-to-play video and even ads behind paywall sites and walled gardens. Spend data for multiple platforms is available including Facebook, Instagram, Twitter and YouTube, as well as video and display channels.

Using Pathmatics, we’re able to quickly understand creative, targeting, device, buying and media placement strategies of advertisers across the digital space. We can research which brands are spending on specific channels, how much they’re spending, see share of voice achieved and the creative messaging being used. We can compare strategies of a set of advertisers within an industry, analyze tactics across industries or drill into a single brand to gain competitive insight.

Source: Pathmatics.com

For example, imagine you’d like to know when your competitor’s ads are running, where they’re appearing and the number of impressions they’re receiving to identify gaps in coverage that can be used as an opportunity for your brand. Or perhaps you’re looking for intel to help design creative that will stand out from the crowd while resonating with your target audience. Pathmatics can provide all of these details and more and even shows the ads on the sites on which they appear.

MRI-Simmons

MRI-Simmons helps us identify and paint a more complete picture of an audience segment by going beyond demographics to reveal their attitudes, opinions and beliefs. This consumer and media analysis tool allows us to access consumer insights such as demographics, psychographics, brand affiliations and media consumption trends. Powered by thousands of attitudinal and behavioral data points obtained through ongoing surveys and passive measurement techniques, MRI-Simmons sheds light on the “why” behind consumer behavior. This level of granularity gives us the ability to drill down to the local level and target specific market segments.

We rely on the MRI-Simmons Insights Platform to quickly access consumer intelligence that allows us to identify behaviors that can be used to shape target audiences and media strategies. With the platform’s powerful search engine, we can gain a better understanding of specific consumer sets, efficiently build segments and develop personas. By reviewing historical trend reports we can learn more about particular behaviors and the mindset of a select audience. We’re able to identify media preferences and consumption habits as well as determine the interests and motivations of consumers.

Source: MRISimmons.com

This tool was the perfect solution to help an agency partner develop user personas for a new business prospect. We began by plugging in the prospect’s demographic data to identify media behaviors (where they consume, what they are watching/reading, etc.) and touchpoints by time of day as well as the factors that influence their purchases. This allowed us to better understand who these consumers are and paint a clear picture by creating a “day in the life” for each. Using raw data like indices and projected percent of the population, we were able to create a full-blown presentation of various personas, complete with names which really helped build the story for the overall pitch that was being prepared.

Complementary Insights Provide Holistic Viewpoint

The various insights gleaned from each of these tools is often combined to create a more comprehensive outlook. For example, Kantar, Pathmatics and MRI-Simmons were all used at various stages of a market research project conducted for a client seeking to expand into a new market with a new concept of their business. Kantar and Pathmatics were used to identify competitive activity like spend levels and placements in two markets to assess the potential to dominate a particular channel. One market clearly stood out by investment alone with $40+ million in expenditures compared to $3 million. Using another of our market research tools, SQAD, we took a deeper look at costs by market to determine which was actually the most efficient.

We then utilized MRI-Simmons Insights at the local level for each market to analyze concentration of the target audience. While both areas were top growing markets, one was slightly larger than the other; however, we found that the target audience made up a larger percentage of the total population in the smaller market. MRI-Simmons Insights also allowed us to analyze the media consumption habits of the target audience at the local market level. This was then compared to the highest indexing media channels to assess overlap with the gaps identified earlier where we found less competitive noise. Finally, current market conditions like the number of competitors, trends in unemployment rates, home values, tourism, etc. were evaluated to determine if one market was growing at a faster rate than the other. This collective intel was used to create a scorecard for each market which informed our overall market recommendation.

All three of these tools were also used to craft a successful digital media strategy for newcomer Varo in the fiercely growing and competitive neobank category. MRI-Simmons was used to analyze target audience media consumption habits and identify over-indexing media channels in select markets. We then used Kantar and Pathmatics to pull expenditure data for competitors and found they were spending heavily in the same tactics (primarily national TV and paid social) with limited expenditures in print, radio and OOH. When overlayed with the audience media consumption data, we found that radio and OOH indexed very high in these markets making these channels a clear winner for connecting with the target audience with less noise from competitors.

The value that each of these industry research tools brings is undeniable. Even better, brands and agencies can leverage our access to these tools through strategic partnerships and project work. At Mindstream Media Group, we are built to be an extension of your team, working closely with you to drive better results for your business. Whether you’re with a brand or an agency, if you’re looking for a partner to help take your work to the next level, connect with us to explore the opportunities.

More from Mindstream Media Group

Meet the Mindstreamer – Chandler Swanner

Chandler Swanner’s interest in advertising dates back to her childhood. Her mother (and role model in life) was a Media […]

Third-Party Cookie Phase-Out: What Marketers Need to Know

Cookies are an essential part of internet usage, allowing websites to remember you and provide a more personalized experience. This […]

Meet the Mindstreamer – Kaya Bucarile

She plans and oversees media strategy for agency clients, working closely with project and platform managers to ensure that we […]