Marketing Insights to Navigate the Coronavirus Pandemic – Weekly Recap of News You Can Use

Week of April 27, 2020

Greetings from the home office.

In this week’s installment, we’re taking a closer look at how the coronavirus pandemic has affected ad spend across media channels.

It’s no secret that consumers’ online behaviors have changed drastically over the last two months in our self-isolated, home office world. We’re testing the boundaries of our internet service through streaming more online video, teleconferencing and homeschooling. We’re likely also engaging more with social media to distract and entertain ourselves from the stress and anxiety of quarantine life. And, our TV habits have probably changed, too, as we look to local and national news to get the latest updates on our ever-changing ‘new normal.’

Marketers’ routines and carefully crafted plans have also been upended. This unprecedented, challenging time has created uncertainty in current and future strategy, including channels, messaging and how to come out of this stronger.

Let’s dig into the numbers.

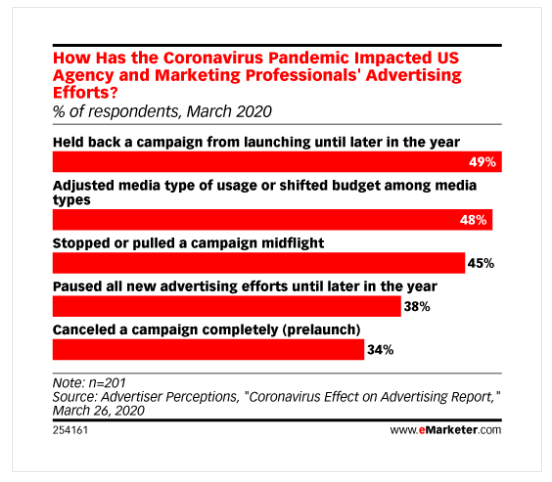

A survey by Advertiser Perceptions found that nearly half of the respondents had held back a campaign from launching until later in the year while 34 percent canceled a campaign completely prior to launch.

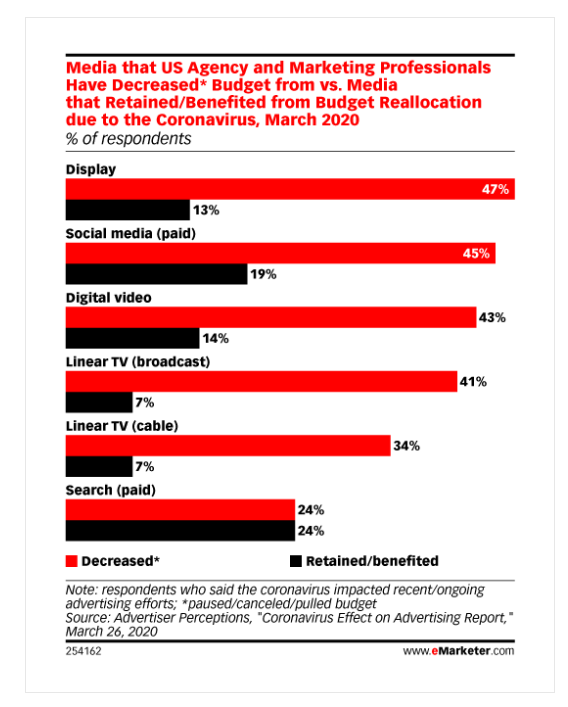

All media has seen a decrease in budget with the hardest hit being display, paid social, digital video and broadcast TV.

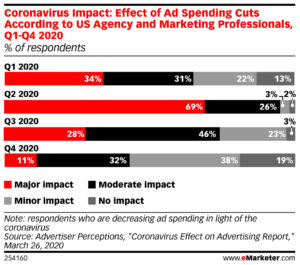

U.S. agency and marketing professionals anticipate Q2 2020 to take the biggest brunt of the impact of cuts in ad spending.

Mobile – According to forecasts by eMarketer, mobile was headed for a banner year in 2020. Ad spend was expected to increase over 20 percent, ringing in at $105.34 billion. But now, any growth in mobile ad spend this year will be minimal at best. However, it will likely not be as hard hit as other media. Early indications are that some spending will bounce back in Q3 and Q4, although it’s too early to determine the extent of the rebound. eMarketer plans to rebuild their forecasting models and release an updated full-year digital ad spend outlook in June. Learn more.

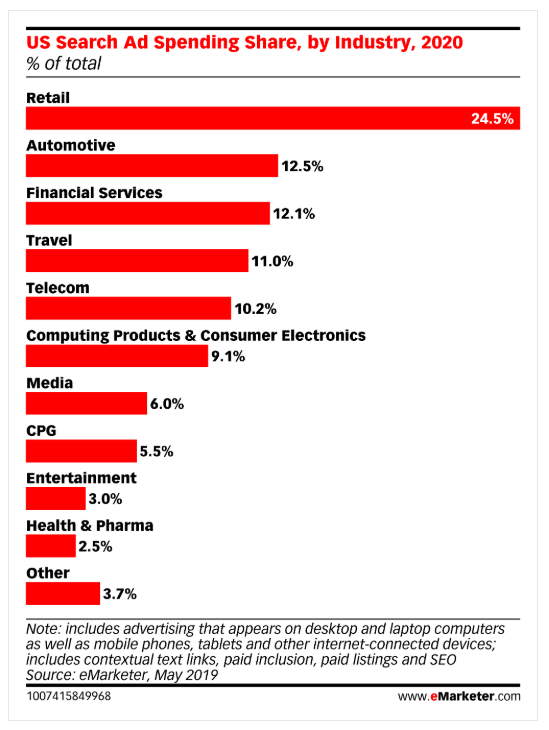

Paid Search – As a performance-based channel with measurable ROI, search budgets often aren’t slashed as deeply as other digital media when marketers are forced to justify allocations. Search is a lower-funnel ad channel typically geared towards driving conversions, online and offline. However, many of those conversions are currently being hampered due to lockdowns and supply chain issues. Although it will vary greatly by industry, overall search ad spending is expected to decline between 8.7 percent and 14.8 percent in the first half of 2020. Learn more.

Digital Video – Video is well-positioned for branding campaigns, which makes it an attractive option as brands refocus their efforts to more upper-funnel tactics. It’s a good substitute for channels like OOH that are facing a decline in consumption. Falling prices due to decreased demand make it an even more attractive option. As a result, eMarketer estimates digital video could have the potential to increase as much as 7.8 percent during the first half of the year. However, that would still be about $3 billion to $5 billion less than originally anticipated. Learn more.

Social Media – Social media advertising spend took a nosedive in March, but plenty of advertisers did not pause or cut spending. In fact, lower ad prices on Facebook actually attracted some advertisers. The pandemic has created a unique opportunity for social media advertising. Not only has demand for ad space decreased due to brands pulling their ads, but the supply of available impressions has soared thanks to increased usage of the platforms by consumers stuck at home. Ad spending is expected to remain depressed in Q2 but rebound by the end of the year, if most of the country has been reopened. Learn more.

Traditional Media Overview – In this video clip, Monica Peart, eMarketer Vice President of Forecasting gives a brief overview of how COVID-19 has impacted U.S. traditional advertising as a whole. (Traditional advertising is defined as live and time-shifted TV, over the air radio, print newspapers and magazines and OOH.) Learn more.

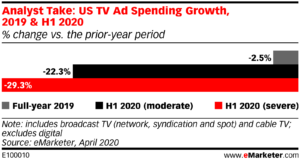

TV – Television, including broadcast (network, syndication and spot) and cable, has seen long-term declines in ad spending. This year was set to be an exception thanks to the Olympics and a presidential election. But the coronavirus pandemic changed all that. The cancellation of sporting events alone caused the loss of billions in ad revenue. Advertisers are expected to take a wait-and-see approach with reviving their expenditures. Although consumers are spending more time at home and have a greater interest in watching TV, many are keeping a wary eye on finances due to job loss or underemployment. This could actually lead to further cord-cutting and reliance on connected rather than linear TV. Learn more.

OOH – Out-of-home is expected to see deeper budget cuts than any other media. Initially estimated to see a 3.3 percent increase in ad spending for the year, OOH is now anticipated to see a decline of 15.5 percent to 21.9 percent in the first half of the year. Stay at home orders and canceled sporting events means fewer eyeballs on once coveted real estate on highway billboards, transit stations, airports, stadiums, restaurant bathrooms, etc. However, once commuting and public activities resume, OOH advertising will regain its popularity and relevance. Learn more.

If you’d like more insights on how media spend and strategies are continually changing, let’s start a conversation.

We hope you’ve found our compilation insightful. Stay safe and if you haven’t already, subscribe to our blog to get next week’s roundup delivered straight to your inbox.

More from Mindstream Media Group

Meet the Mindstreamer – Chandler Swanner

Chandler Swanner’s interest in advertising dates back to her childhood. Her mother (and role model in life) was a Media […]

Third-Party Cookie Phase-Out: What Marketers Need to Know

Cookies are an essential part of internet usage, allowing websites to remember you and provide a more personalized experience. This […]

Meet the Mindstreamer – Kaya Bucarile

She plans and oversees media strategy for agency clients, working closely with project and platform managers to ensure that we […]