Monday marked the fourth annual Amazon Prime Day. This year, Prime Day will run for 36 hours making it the longest version of the holiday yet.

For almost half a decade, the mid-summer tradition has been disrupting the holiday-shopping calendar, with this year’s festivities kicking off July 16th at 3 p.m. on the East Coast.

Even with some initial hiccups this year (more on that soon), Prime Day is still a force to be reckoned with for online and brick-and-mortar retailers alike. Here are the top takeaways for brand marketers from Prime Day 2018.

A dog day afternoon

You might expect some websites to crash from an onslaught of traffic, not Amazon though… right? Well, sure enough, the rush of shoppers on Prime Day was enough to cause significant issues on Amazon’s website and mobile app.

According to reporting from The Verge:

The outage is restricted to the US, and it appears to still be affecting large parts of California and the New York as of 5:30 p.m. ET, with a smattering of smaller outages in the Pacific Northwest and other parts of the country.

Some users have reported being able to access product pages but not the Amazon.com homepage. Some are not experiencing issues at all, while others are seeing the company’s well-known “dogs of Amazon” page, which is the company’s placeholder art during full-blown outages that highlights well-known pets of Amazon employees.

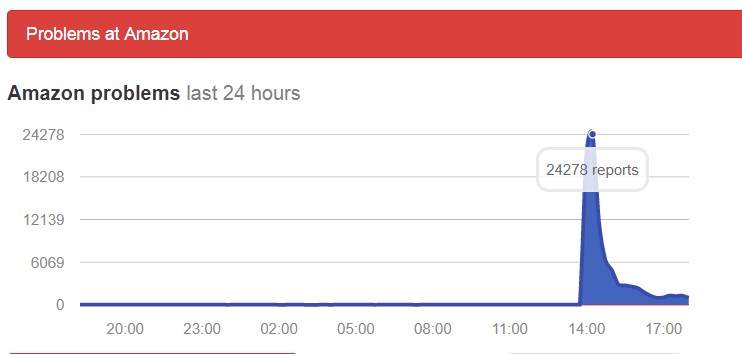

According to downdetector.com, the problems began pretty much right as Prime Day began Monday afternoon.

Somewhat ironically, I was able to replicate this issue while shopping for dog beds around 7:30 p.m. ET, hours after Prime Day began.

Not everyone experienced this issue and apparently, there are ways around it. According to Amazon, despite the glitches, this year’s Prime Day still got off to a better start than 2017.

— Amazon.com (@amazon) July 16, 2018

Primed for growth

With an extra six hours of deals, Prime Day 2018 is expected to be the most lucrative edition for Amazon yet. According to projections from Internet Retailer:

Shoppers will spend $4.04 billion on Amazon during its fourth annual Prime Day this year. That’s a 67 percent jump from the Internet Retailer-estimated $2.41 billion in sales on Prime Day last year (held on July 11, 2017). In the U.S., shoppers are expected to spend $2.5 billion, Internet Retailer estimates. Comparatively, last year Amazon grew its overall Prime Day sales by 60 percent year over year during the 30-hour sale.

Amazon Prime Day: Better than Black Friday?

Amazon’s efforts to drive sales during a typically slow season for retail is gaining steam. While it’s still not at the same level as Black Friday, reporting from Business Insider shows Prime Day is starting to close the gap.

Cowen & Co. estimates that Prime Day generated about $1 billion for Amazon last year, while e-commerce sales totaled $5.03 billion on Black Friday, according to Adobe.

But the deals are better than what shoppers might find on Black Friday, according to BestBlackFriday.com. The website analyzed Amazon’s deals on Black Friday and Prime Day in 2016 and found that 77 percent of Prime Day prices were better than comparable deals offered on Black Friday.

According to numbers from the National Retail Federation, Prime Day isn’t just increasing in popularity, it’s also hurting Black Friday shopping numbers. In 2017, roughly 174 million customers shopped in-store and online over the Thanksgiving holiday weekend, down from 226 million in 2011.

Local retailers not ready for Primetime

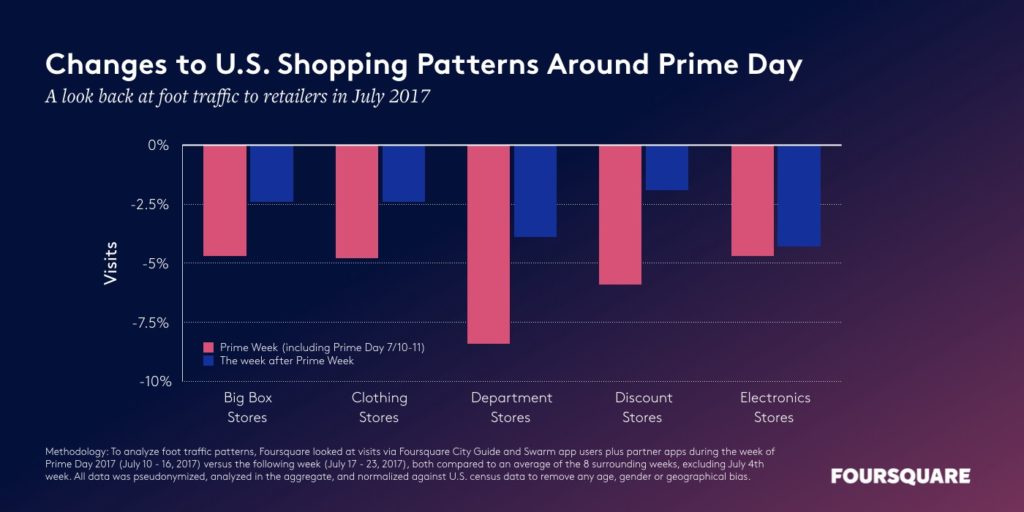

The majority of retail shopping – roughly 90 percent – still happens at local stores. However, Prime Day made a serious, albeit temporary, dent in that rate in 2017.

According to research from Foursquare:

As compared to an average summer week (excluding July 4th week), we found that all major retail categories saw a dip in foot traffic around Prime Day, with some recovery seen the week following (July 17 to the 23rd).

Other retailers are fighting back

For years, retailers have been experimenting with ways to compete with the e-commerce juggernaut that is Prime Day. This year, retailers continued to ramp up those efforts.

According to reporting from Business Insider:

JCPenney, for example, held its biggest two-day sale this week ahead of Prime Day, and will hold another three-day promotion, called “Cyber-in-July,” starting Monday.

Macy’s, meanwhile, is holding a “Black Friday in July” promotion this week offering 25 percent off most of the site, and Lowe’s is offering 10 percent off sitewide on Monday and Tuesday for new and existing MyLowe’s Customers. Lowe’s is also giving out free Google Home Mini devices to shoppers who spend more than $150 on Lowes.com.

In addition to running their own promotions, many retailers will price-match Amazon’s Prime Day deals. These retailers include Home Depot, Staples, Best Buy and Bed Bath & Beyond.

For its part, Target put on a one-day sale offering online deals store-wide today. A wink to Amazon Prime’s free shipping perk for members, Target is also offering free same-day delivery memberships for six months for shoppers who spend $100 online.

Image source: Target

Apparently this effort to jump on Amazon’s bandwagon is working for retailers. According to data from Adobe Analytics data:

- Online visitors to major retailers on Prime Day last year were 35 percent more likely to make a purchase.

- Non-Amazon e-commerce outlets saw a 17 percent increase in online purchases.

Related: Advertisers Wake to Amazon’s Giant Opportunities