Recently, we kicked off our connected TV series with a look at the convergence of digital and linear models. In this post, we’ll take a deep dive into the digital landscape by looking at the growth of connected TV audiences and the major OTT services vying for viewers’ attention.

It’s been nearly a fortnight since Game of Thrones reached its highly-anticipated conclusion. Over the last week and a half, millions of viewers watched (and re-watched) the series finale to find out which of Westeros’ finest would end up on top, only to see the hotly-contested, blade-forged metal death chair (SPOILER ALERT!!!) reduced to a puddle of melted steel and broken dreams. In the end, 13.6 million viewers tuned in live to catch the finale, with another 6 million or so streaming the episode or watching it on-demand.

As the final clash for the Iron Throne unfolded, a related battle raged across the digital media realm. Over-the-top (OTT) video providers like Netflix, Hulu and Amazon Prime Video continue to fight for the loyalty of viewers who are increasingly ditching traditional TV providers in favor of internet-connected viewing options.

For marketers, these connected TV audiences represent an increasingly significant opportunity to blend digital’s ad targeting capabilities with traditional TV’s massive reach. To give you a better understanding of the opportunity, here’s a look at the growth of connected TV audiences, the OTT services battling for viewers’ attention (and dollars) and the devices that deliver the content.

Connected TV audiences

Let’s start by clearing up the confusion between connected TV and OTT. Connected TV refers to the devices audiences use to stream video (e.g., a smart TV). OTT services are the apps and providers that deliver the content (e.g., Netflix). To frame up this article, we’ll use connected TV audiences as a catch-all for viewers watching OTT content on internet-connected devices.

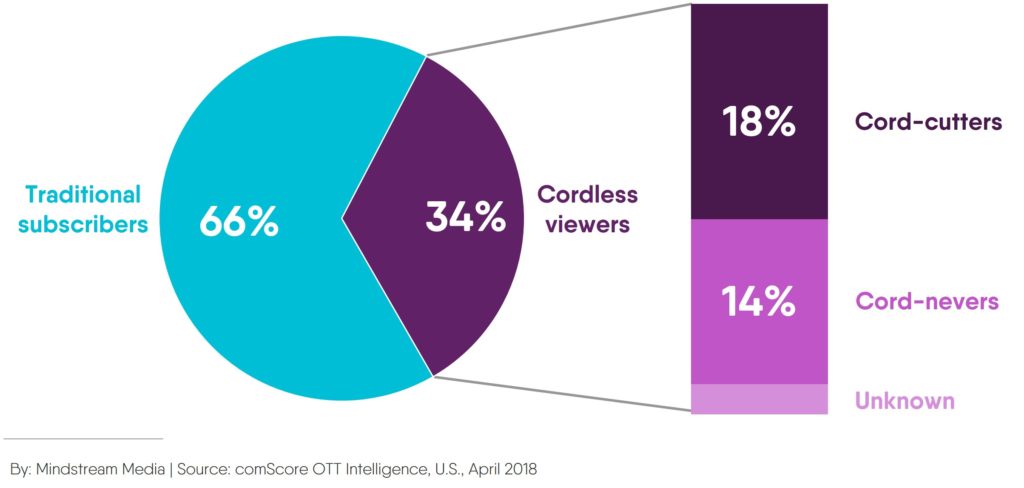

Connected TV audiences are comprised of two main groups:

No. 1: Traditional subscribers

Audiences who stream OTT video and also subscribe to traditional TV distributors like:

- Cable and satellite providers

- Wireless carriers and fiber operators

- Major TV broadcast and cable networks

- Internet Protocol TV (IPTV) providers

No. 2: Cordless viewers

Audiences who don’t have any traditional pay-TV service, comprised of two main groups:

- Cord-cutters: have had a traditional TV subscription in the past five years

- Cord-nevers: have not had a traditional TV subscription in the past five years

OTT streaming households by audience type

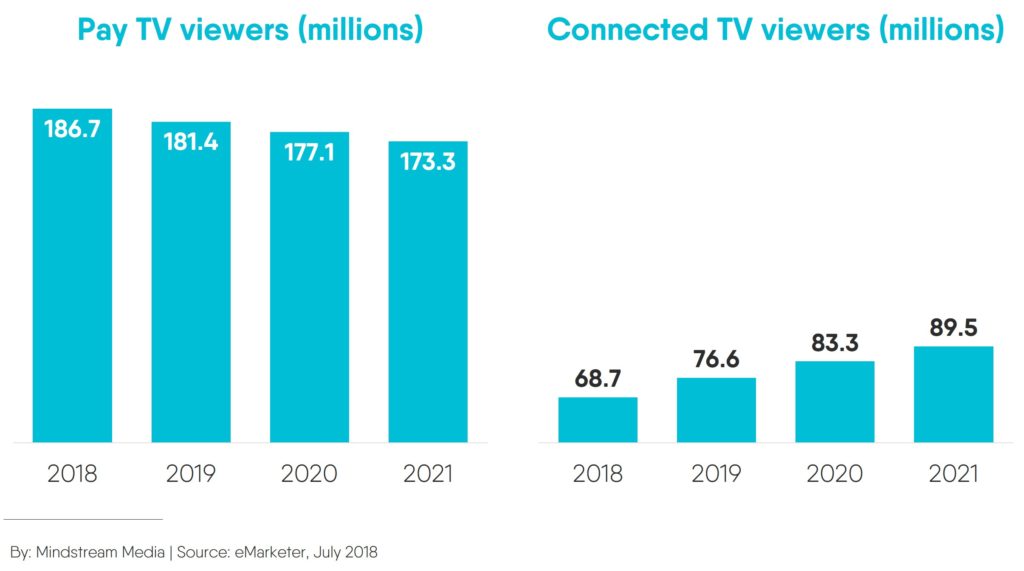

While traditional TV (i.e., pay TV) viewers still outnumber connected TV viewers roughly 2-to-1, the tides are starting to turn. This trend is significant for brand marketers who will need to reallocate budgets to account for the shift in consumer behavior.

Major OTT players

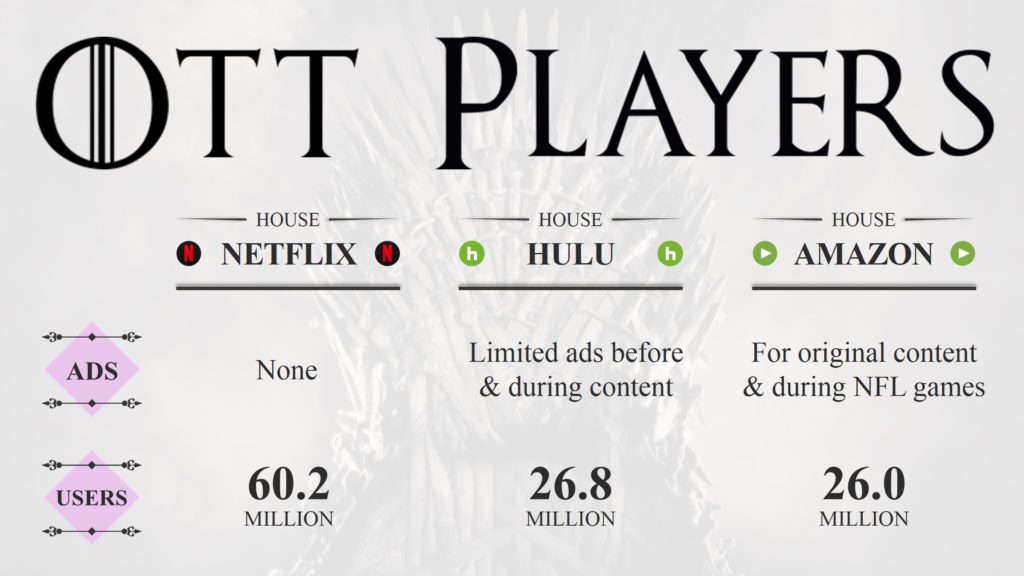

The growth of connected TV audiences has sparked an arms race among OTT video providers vying for their attention. It seems like a different media company launches a new OTT service every day as existing players jockey for the rights to popular video content and work to develop more original programming. Going back to the GoT analogy, there are three main houses in the race today: Netflix, Hulu and Amazon Prime. Think of them like connected TV’s versions of the Starks, Lannisters and Targaryens.

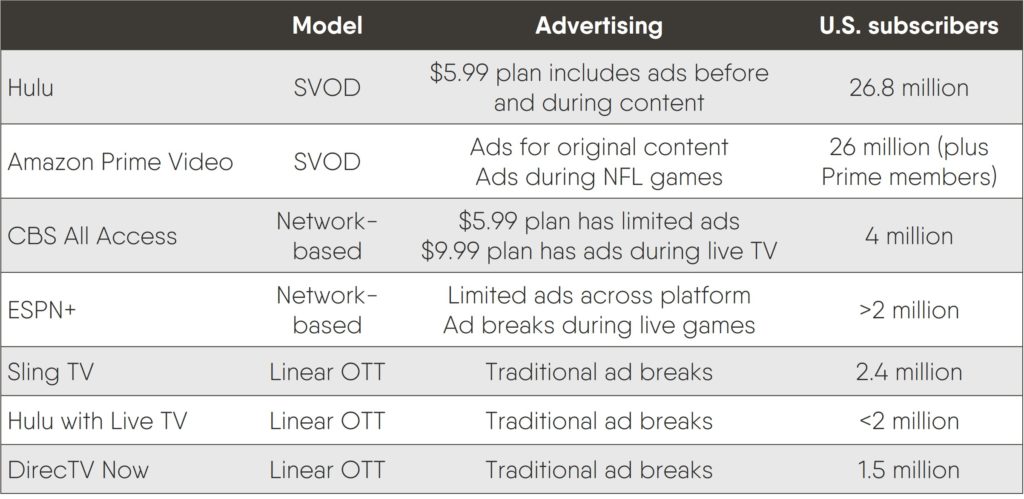

But, like GoT, the OTT realm has a lot more houses, and these services use a variety of content and delivery models. There are way too many models to cover here, but let’s look at a few of the big ones:

- Subscription video-on-demand (SVOD) model: OTT services that give users access to a wide range of original and aggregated content for a monthly rate (e.g., Netflix, Hulu, Amazon).

- Network-based model: SVOD services built around TV and cable networks (e.g., HBO GO/NOW, Showtime Anytime, CBS All Access).

- Linear OTT model: OTT services that deliver content from multiple TV, cable or satellite channels in real time (e.g., DirecTV Now, Hulu with Live TV, Sling TV).

These services are a mix of subscription- and ad-based models, making some of the services less attractive to marketers. Here’s a look at the major ad-based services across the various models.

OTT providers with advertising

(Source: eMarketer)

Across content and subscription models, there’s plenty of momentum behind OTT right now. Despite nearing what has to be an audience saturation point, market leader Netflix continues to grow. Other major platforms like Hulu and Amazon Prime Video are still growing as well. On top of that, big names like Disney and Apple have plans to launch their own services in the coming months. For marketers, this means OTT platforms will likely become an even more important channel for reaching consumers in the near future.

Connected TV devices

Perhaps the biggest difference between OTT apps and traditional TV providers is how they deliver content to audiences. With traditional TV, audiences are pretty much tethered to their TV sets and – with the exception of on-demand content – are forced to watch programs live. With OTT services, audiences have a lot more control of where and when they consume content.

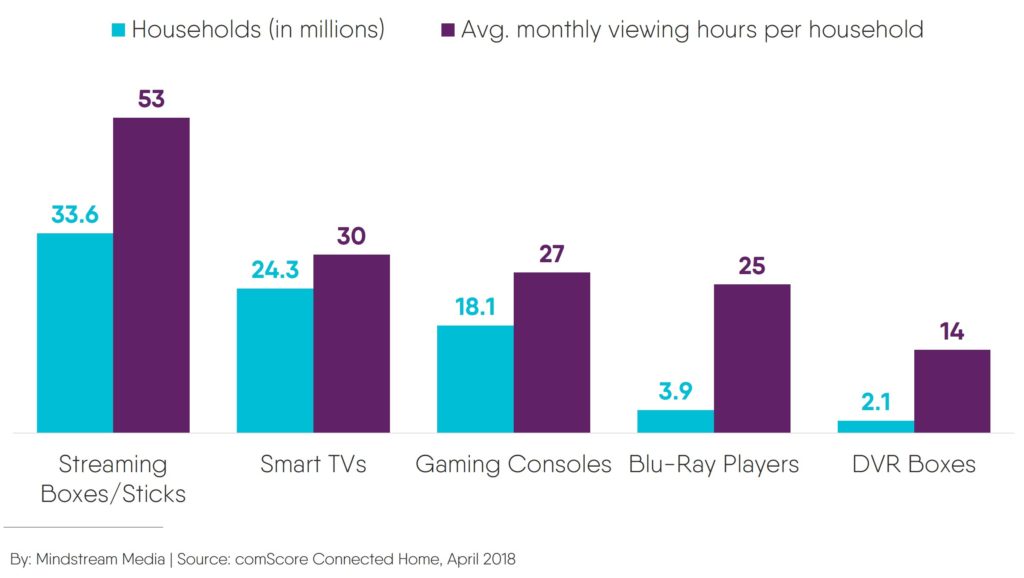

Connected TV devices come in all shapes and sizes including smart TVs, gaming consoles, streaming boxes/sticks, etc. (Additionally, viewers can use computers, tablets and phones to stream OTT content.)

OTT streaming households by connected TV device

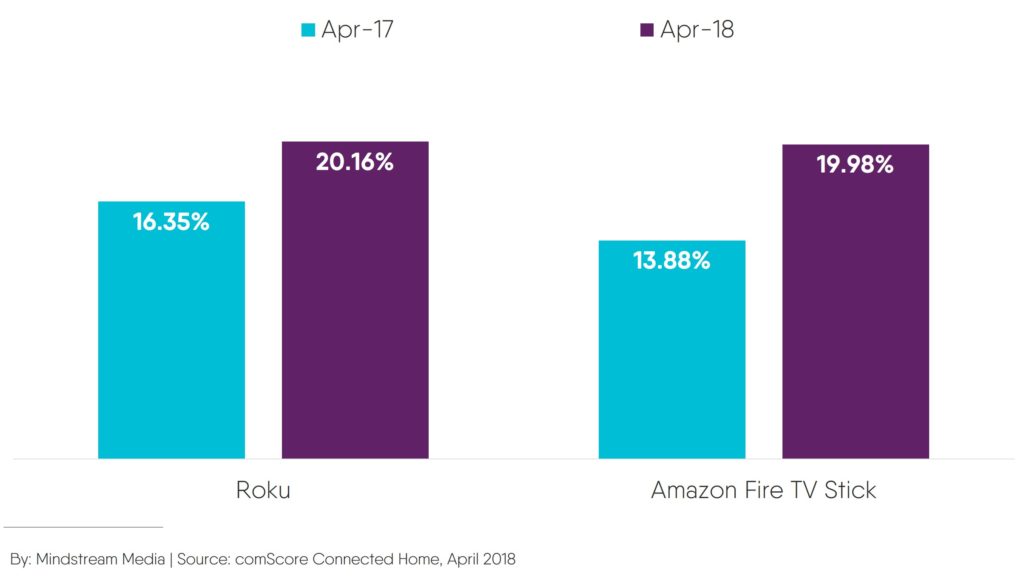

As of last year, streaming boxes and sticks were the most popular connected TV device. The two major players in the category are Roku and Amazon’s Fire TV Stick, both of which experienced solid growth in 2018.

Roku and Amazon Fire TV Stick penetration of U.S. Wi-Fi households

To learn more about connected TV advertising, check out the third installment of this series:

Don’t miss any of the latest news in marketing and media! Subscribe to Mindstream Media Group’s blog and get future articles delivered straight to your inbox.