2020 Trends in Financial Services Marketing

There are more ways to reach consumers, or your potential clients, than ever before. Digital channels, social platforms and targeting capabilities are growing at a tremendous rate, but which industries are using these to the best of their ability and where do the opportunities lie?

The financial services category is keeping pace with other verticals in terms of overall ad spend, but let’s take a deeper look at some of the current trends (and opportunities) in this industry.

Trends in Financial Services Marketing

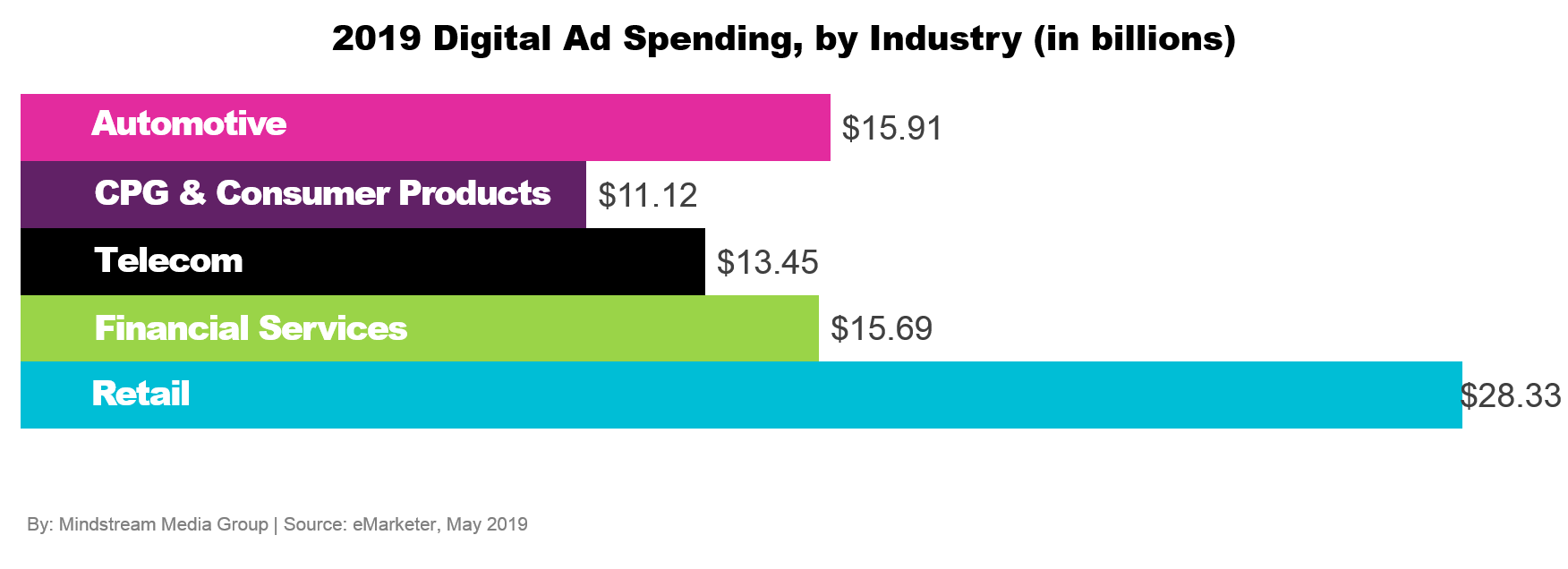

Which industries are spending the most on digital? According to eMarketer, the top five include retail, automotive, financial services, telecom and CPG products.

Financial Services places second in digital ad spend

Looking more specifically at the financial services category, that $15.69 billion digital spend is expected to reach $18.25 billion in 2020, overtaking automotive to claim the number two ranking in terms of overall ad spend.

The rise of mobile

The rise of mobile

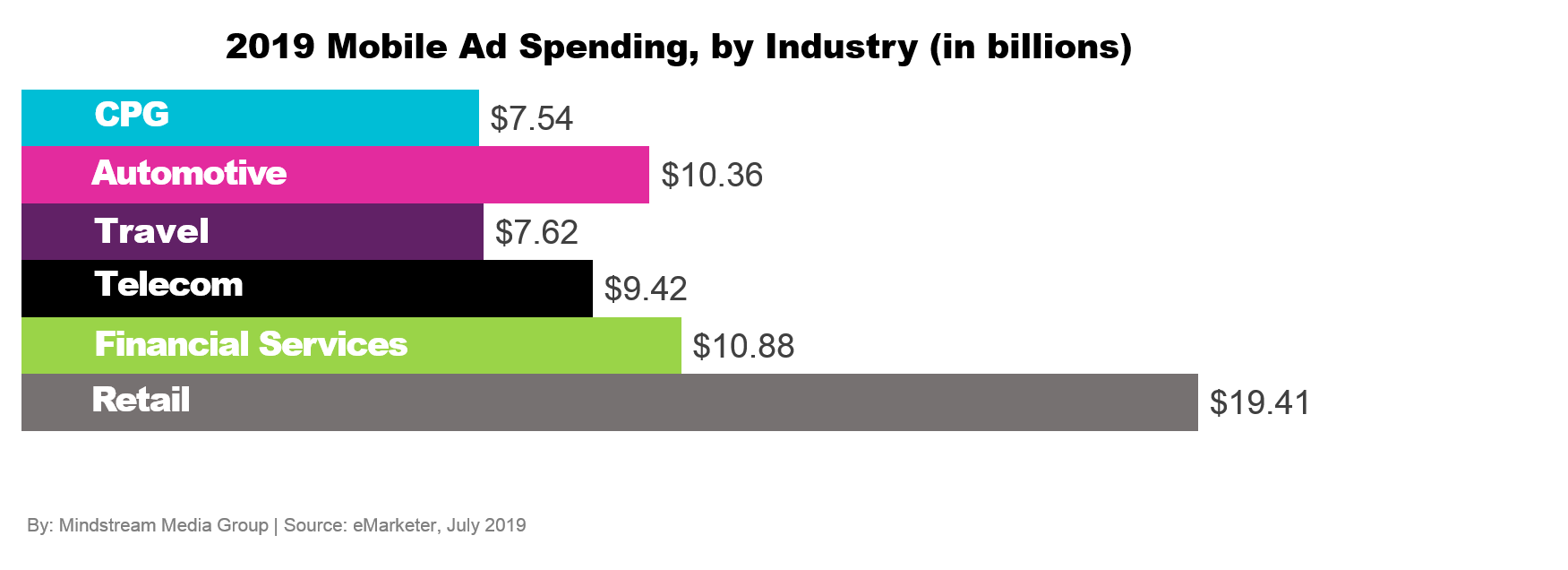

While financial services’ year-over-year digital ad spending growth rate aligns with the average for other industries, this industry in particular has leaned heavily into mobile – more so than other verticals – with the goal of making financial products more accessible to a wider variety of users – specifically, younger users – through their mobile devices.

Mobile accounted for 69.4 percent of total financial services ad spend (at $10.88 billion) in 2019 and will increase to 73.1 percent in 2020. Compared with other verticals, financial services over-indexes on mobile spend and is second only to retail in terms of overall mobile spend.

“Millennials are more digitally focused than previous generations. And identifying a meaningful, relevant way to connect with them through products they find interesting is a priority for financial services advertisers. This is indicated in financial advertisers’ increase of mobile spend. They realize it’s important to connect with users where they are accessing, researching and using financial products,” according to Sarah Scherer of digital media buying firm Goodway Group.

Comparatively, desktop budgets in financial services are growing slower than other verticals – 2019 desktop spend in financial services grew 9.6 percent while total desktop across industries grew 12.8 percent.

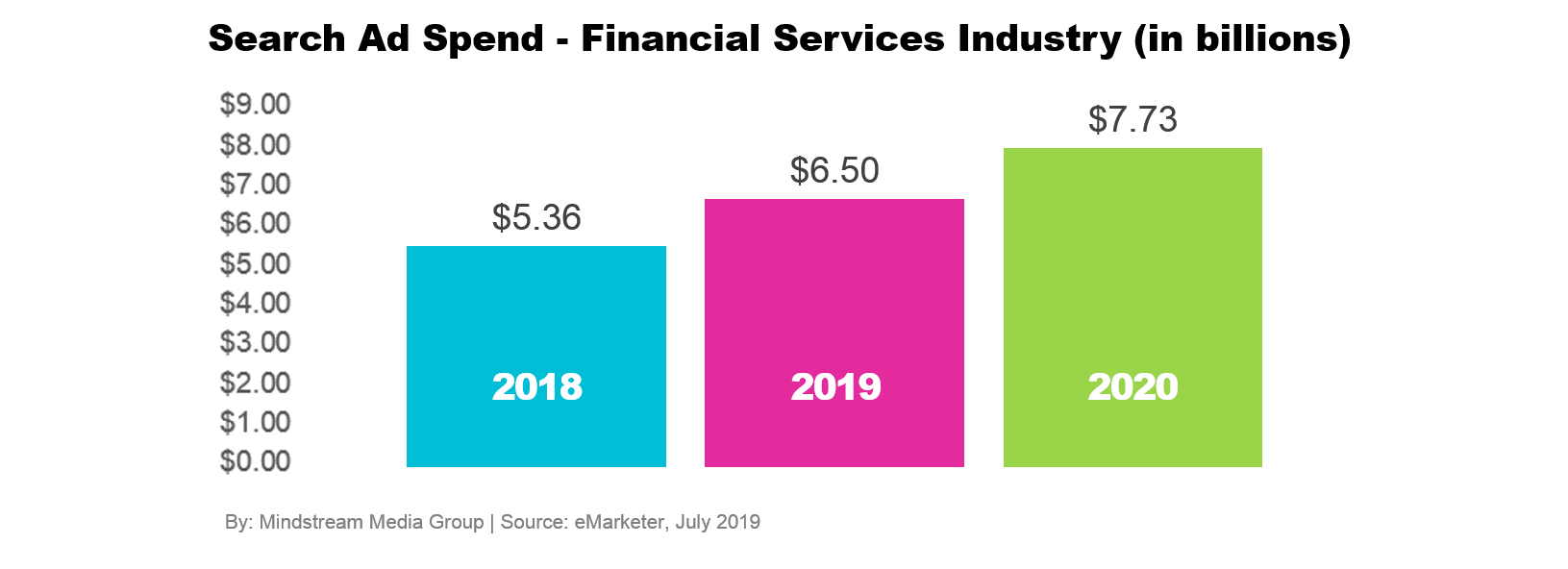

Display and search are dominant formats

In 2019, financial services advertisers spent $8.18 billion on display and $6.5 billion on search. While display spend increased by 18 percent from the previous year, search grew by over 21 percent, making it the fastest growing format for financial advertisers. In 2020, search spend is expected to reach $7.73 billion and will account for 42.3 percent of total financial services digital ad spend.

It’s worth noting that it’s not enough to simply have search and display campaigns at the national brand level. Potential customers need to know where to find a relevant local business associated with that brand. That’s where local search comes in, and it’s one of Mindstream Media Group’s primary media solutions.

Traditional media is still a key player

Even with the rise in digital media ad spending, traditional media still plays a key role in brand marketing campaigns. In 2020, advertisers will spend $151 billion on digital advertising while traditional media will bring in $107 billion.

In 2019, consumers spent an average of 354 minutes per day on print, radio and TV combined. Over five hours per day in consumer attention is huge for brand recognition, making traditional media a priority among financial services brands.

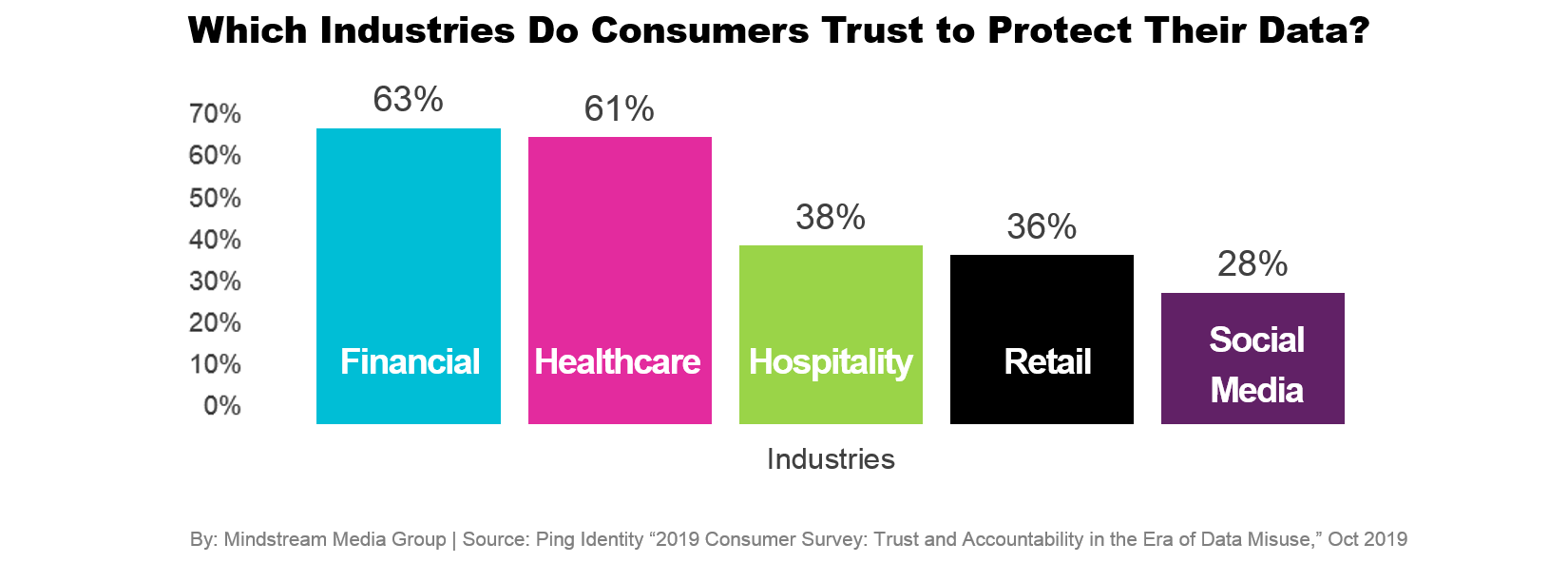

Consumer trust is high

Consumers trust the financial industry over any other industry to protect their data. Even more than the healthcare industry, consumers rely on their financial institutions to keep their personal data safe.

So, what drives consumer trust? First, a brand’s ability to protect consumer data from breaches, as well as not using the data without permission, Eighty-one percent of people say that a data breach would cause them to stop engaging with a brand, while 55 percent say a company sharing their data without permission would most likely deter them from using that brand’s products.

Some would argue that trust is about providing a personalized and data-driven customer experience, meaning financial brands actually use the data collected from consumers to improve and optimize not only their own strategies to provide meaningful communication, but also to make it easier for potential and current customers to do business with them.

It’s about embracing a comprehensive strategy across multiple channels, that customizes marketing messages to the targeted audience’s stage in their own buying journey.

Opportunities in Financial Services Marketing

Taking these trends in financial services marketing into consideration, let’s take a look at some of the opportunities that financial brands can consider.

Use the data (but only with permission)

Consumers have become accustomed to marketing personalization in their daily lives. Recommended products based on their browsing and purchase history, abandoned cart reminders and the ability to pick up where they left off in their favorite streaming shows have all proven the capability not only exists, but also that marketers are using their collected data to step up their game to enhance the customer experience.

It’s not enough to have the data or the technology to collect more, it’s about using it to provide a better customer experience. Sixty-five percent of financial marketers say that while they do use their institution’s data to discuss, educate and cross-sell customers, they don’t use it as often as they should or would like to.

There is a lot of opportunity to personalize marketing using consumer data, but with the caveat that users should have a means of granting permission to the usage of their personal data.

Optimize for voice search

Smart speaker usage is growing rapidly, surpassing 83 million U.S. users in 2020, 25 percent of the country’s population. While voice search marketing capabilities are still in the early days, one quarter of marketing professionals say that voice will be an extremely important marketing channel over the next 3-5 years. Prepare for the future of voice now via your keyword and content strategy, among others.

Explore content marketing formats

Financial marketers rate video marketing as the most effective content type they use, at over 44 percent, followed by blogs, eNewsletters, whitepapers and eBooks. Video can help answer consumers’ questions through tutorials, teach via a webinar format, inform with an interview or help humanize a brand by showcasing its employees.

Podcasts are also an increasingly popular content format in the financial community, so brands can and should take advantage of unique opportunities in this space. Podcasts have dedicated, highly engaged listeners and many of the ads are read by the hosts themselves. Fifty-four percent of podcast listeners are more likely to consider a brand after hearing it advertised on a podcast. Even more of a selling point for podcast advertising is that although some streaming platforms offer an ad-free subscription, listeners will still hear ads placed within podcast episodes.

Expand social beyond Facebook and LinkedIn

Twitter’s FinTwit community has become a huge resource and forum for elite investors, bankers, billionaires and advisors. While it’s still social in the fact that some content can be irrelevant or derail easily, following the right profiles and engaging in the right conversations can have a positive impact on brand engagement.

There’s no doubt the financial services industry has its own unique marketing trends and opportunities. What’s important for advertisers to remember, is that a unique and holistic marketing strategy must be forefront in order to grow.

More from Mindstream Media Group

Meet the Mindstreamer – Chandler Swanner

Chandler Swanner’s interest in advertising dates back to her childhood. Her mother (and role model in life) was a Media […]

Third-Party Cookie Phase-Out: What Marketers Need to Know

Cookies are an essential part of internet usage, allowing websites to remember you and provide a more personalized experience. This […]

Meet the Mindstreamer – Kaya Bucarile

She plans and oversees media strategy for agency clients, working closely with project and platform managers to ensure that we […]